HONOLULU OFFICE MARKET REPORTS

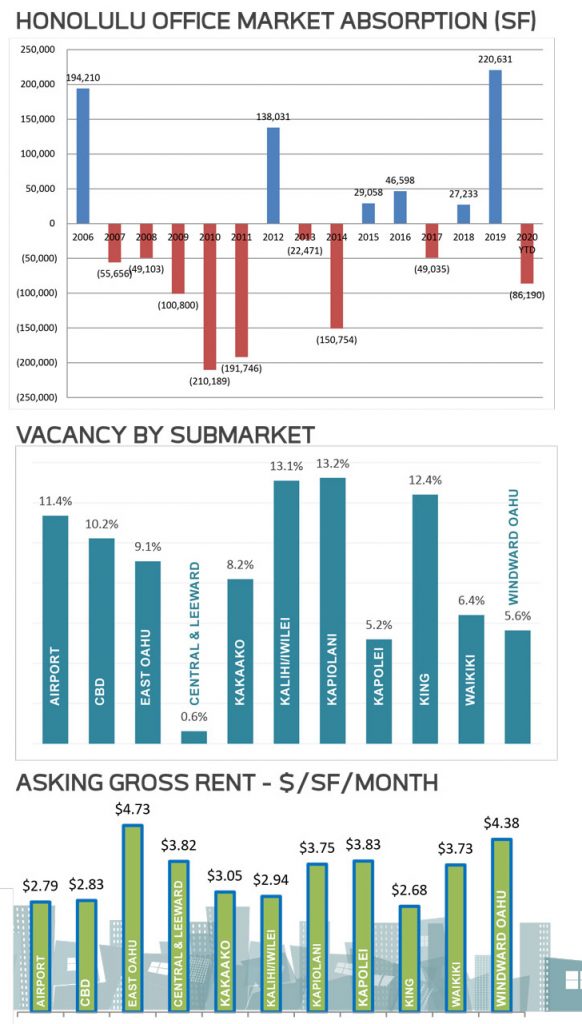

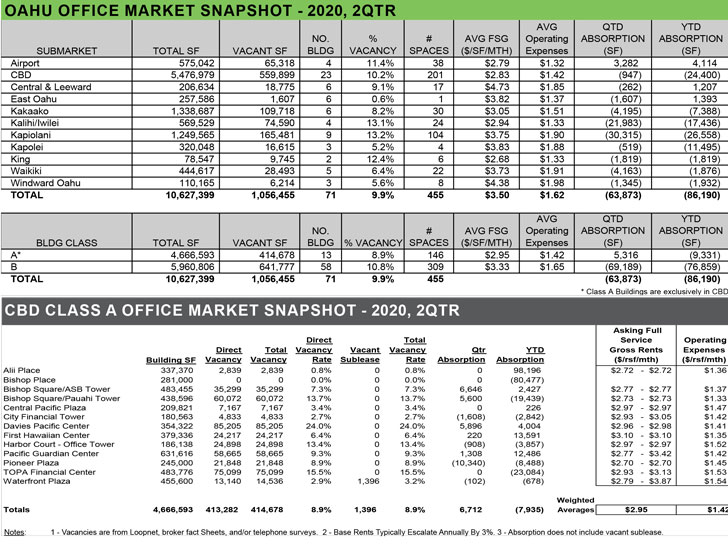

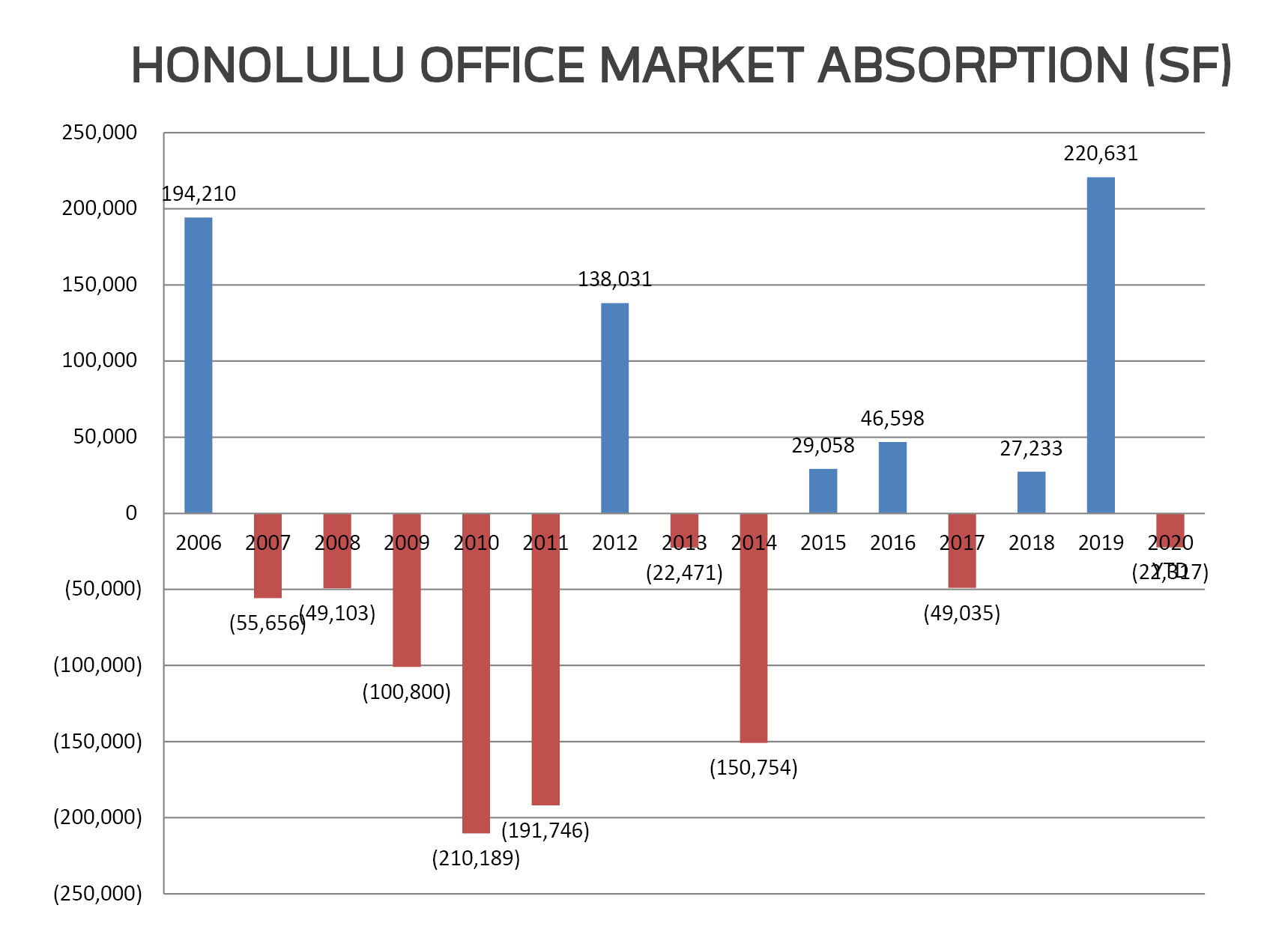

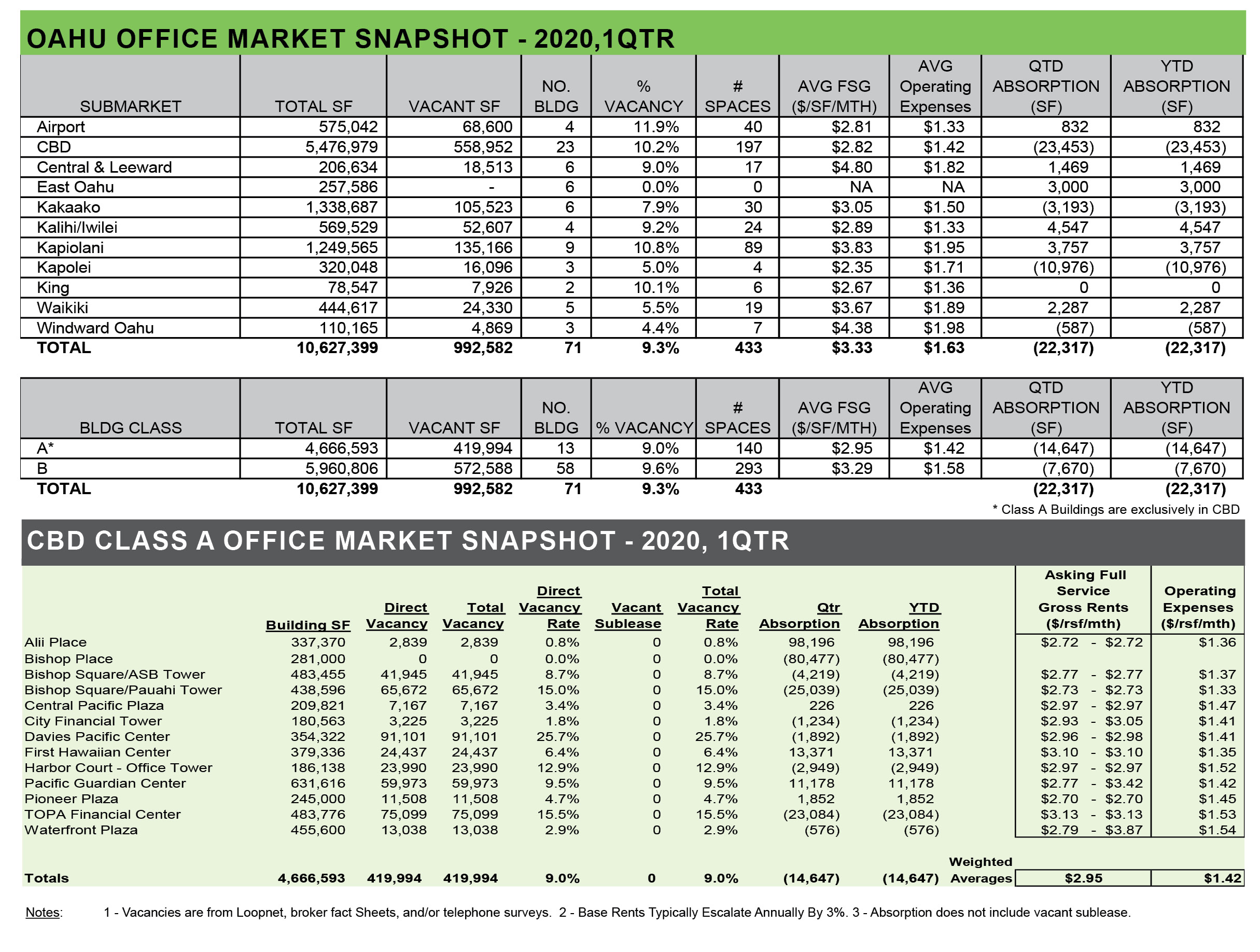

The 2nd quarter of 2020 showed an acceleration of COVID 19 impacts as the Honolulu office market registered 63,873 sf of negative absorption which is on top of 22,317 sf of negative absorption in the 1st quarter. Showing activity continued to be very slow with most office tenants still working from home.

The 2nd quarter of 2020 showed an acceleration of COVID 19 impacts as the Honolulu office market registered 63,873 sf of negative absorption which is on top of 22,317 sf of negative absorption in the 1st quarter. Showing activity continued to be very slow with most office tenants still working from home.

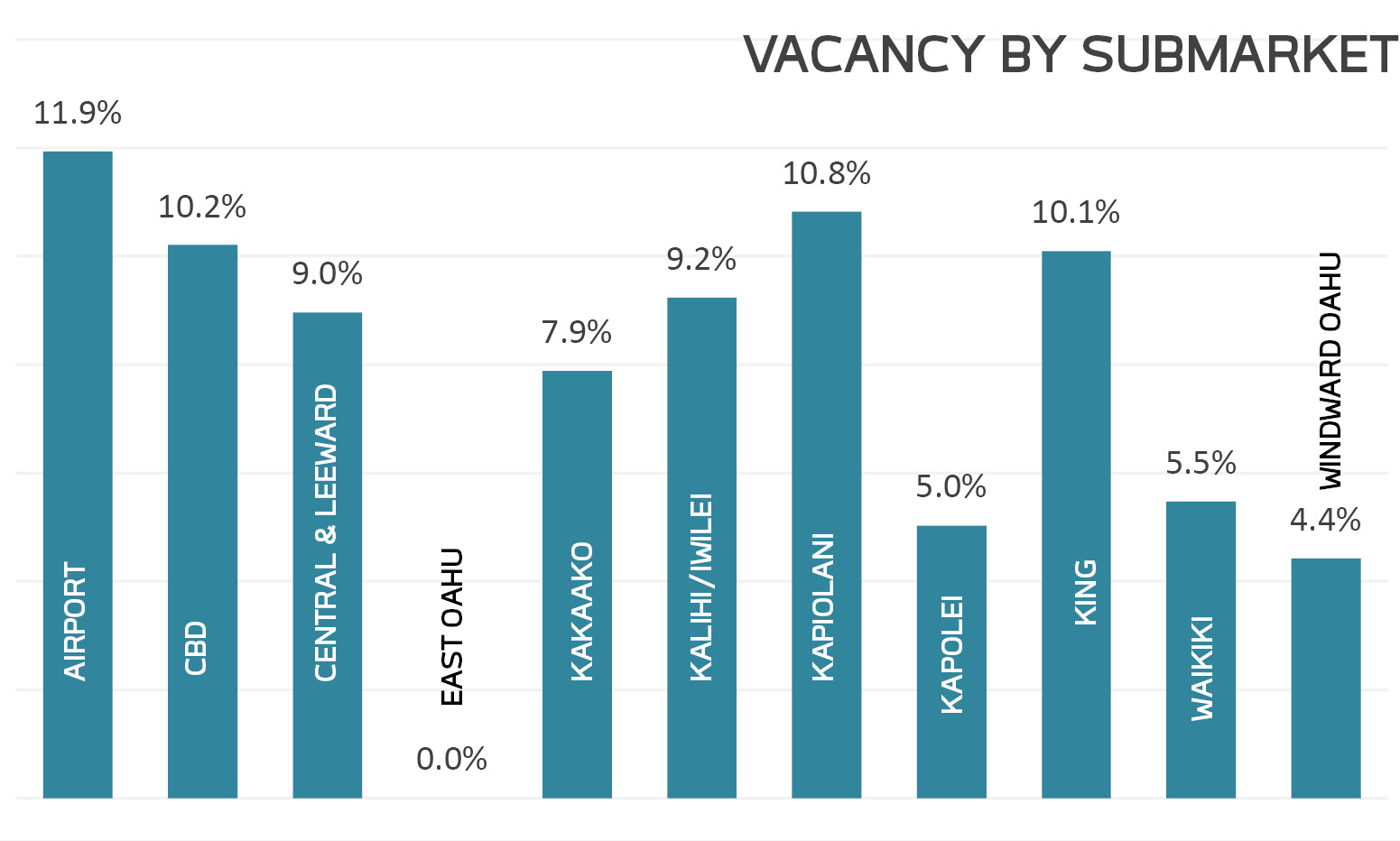

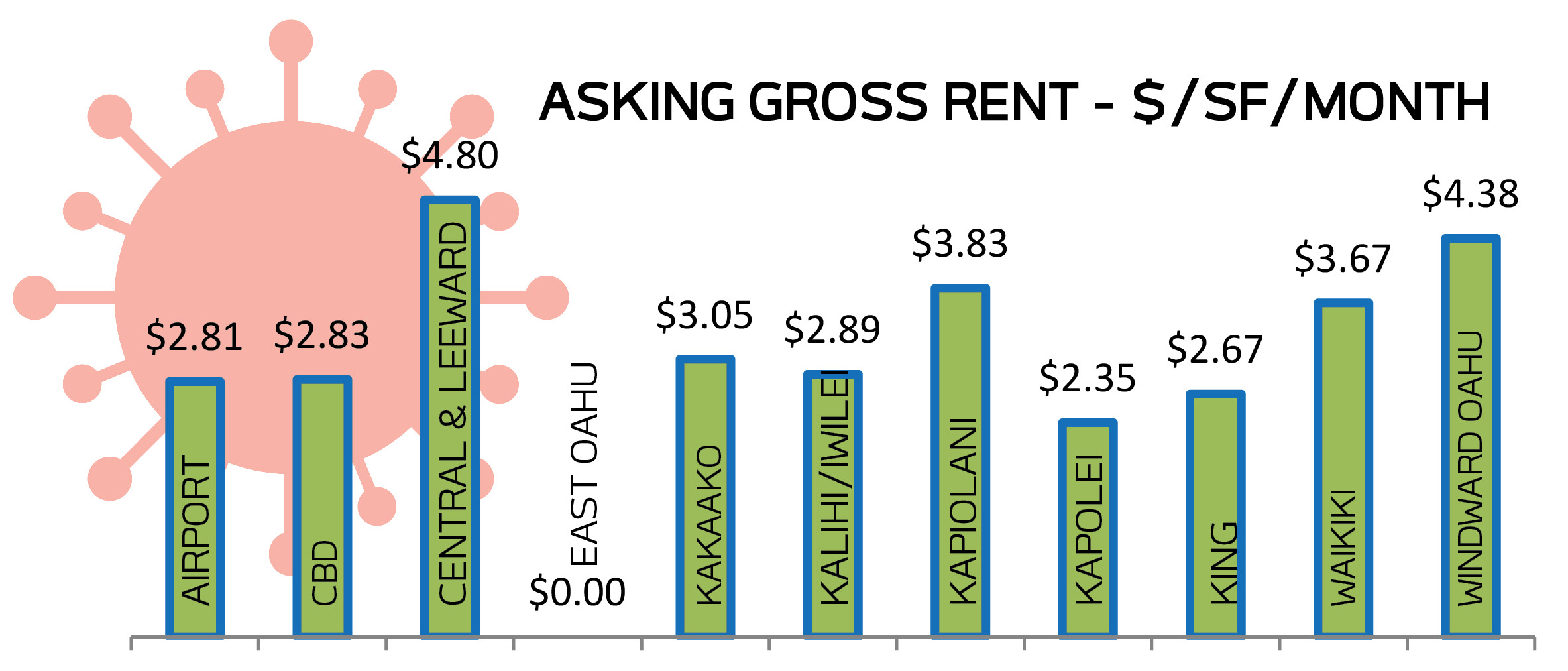

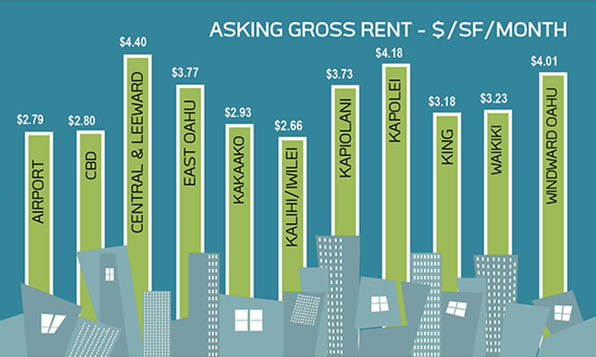

Interestingly, Full-Service Gross (FSG) asking rent INCREASED to $3.50/sf/mth while the included operating expenses decreased to $1.62/sf/mth. Hawaii Commercial Real Estate’s index of available spaces increased to 433 spaces across the island.

COVID IMPACTS AND “SHADOW VACANCY”

It seems clear that COVID will cause more negative absorption as office tenants embrace hoteling (desk sharing) and virtual work; and Hawaii’s damaged economy results in business closures and downsizing. However, because office leases typically run multiple years, it will take time for the COVID downsizes to show up in direct vacancy figures.

We are already seeing an increase of sublease listings, but because most are at least partially occupied, they do not show up in our vacancy numbers – we only count vacant sublease. Beyond spaces officially listed for sublease, we are seeing an increase in “shadow vacancy” which is excess leased space that is available – essentially off-market sublease space.

FACTORS THAT COULD MITIGATE COVID DOWNSIZING

1132 Bishop Place still has over 250,000 square feet of office tenancy, much of which will move to other office buildings in the next several year and both IRS and HART must move out of Alii Place to make way for HECO’s expansion. IRS has signed a lease at Pauahi for 21,000 sf which will show up as positive absorption in late 2020. Like the rail project in general, no one seems to know where HART will move.

We did, however, see an immediate and dramatic reduction in leasing activity in late March as Honolulu’s economy was shutdown with stay-at-home orders and a near total travel ban that reduced daily visitor arrivals from about 30,000/day to about 100/day.

Honolulu’s office market started the year with 22,317 sf of negative absorption which was due primarily to: Bishop Place removed about 81,000 sf of Class A office for conversion to residential rentals which nearly offset HECO’s lease of 98,000 sf at Alii Place, and University of Phoenix gave back space at Topa Financial Center downtown and Hale O Kapolei. Bishop Place still has about 281,000 sf of tenancy which will eventually either move to other office buildings or evaporate. Despite the negative absorption, vacancy declined to 9.3% because 1833 Kalakaua and a portion of Bishop Place were removed from the office market.

Full-Service Gross (FSG) asking rent decreased to $3.33/sf/mth while the included operating expenses increased to $1.63/sf/mth. Hawaii Commercial Real Estate’s index of available spaces decreased to 433 spaces across the island.

COVID-19 IMPACTS AND QUESTIONS

It’s too early to know the impacts of COVID-19 on the Honolulu office market, but it seems that it could rival the seismic changes of 2019 when Douglas Emmett began their conversion of Bishop Place to residential and HPU moved to Waterfront Plaza.

Most office tenants have been able to work from home during the lockdown with a few exceptions like some medical offices. Unlike retail tenants who saw their income drop precipitously in late March, office tenants typically have a delayed income stream as they collect payables 30 days or more after performing services, so most had not seen the economic impact by the end of March, and most office tenants paid rent for April. We did see a few small month-to-month tenants give notice of termination, and few office tenants ask for rent relief. We have seen a few landlords offer rent forbearance (delayed rent payment) but not rent abatement. May, June and later rent collections will begin to tell the real story of the economic impact.

Big question marks remain for the office market. When and how will Hawaii’s economy open up, particularly the visitor industry which makes up 20% of Hawaii’s GDP? What will be the extent of COVID-19 related office job losses? Will social distancing require tenants to reconfigure their offices (potential boon for office furniture dealers)? Will office tenants need more space for social distancing? Will office tenants need less space because they can work entirely or partially from home?

OTHER QUESTIONS

Beyond COVID-19, other questions loom over the Honolulu office market. Where will the IRS and HART move as they are forced out of Alii Place by HECO’s lease? HECO leases 250,000 sf in six other buildings – when and how much will HECO give back to the market as they move into Alii Place? 281,000 sf of tenancy remains in Bishop Place – how much will move? When and to where?

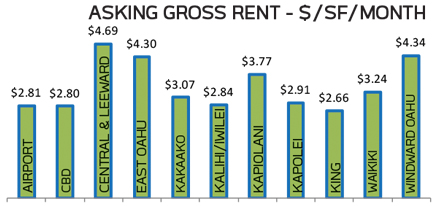

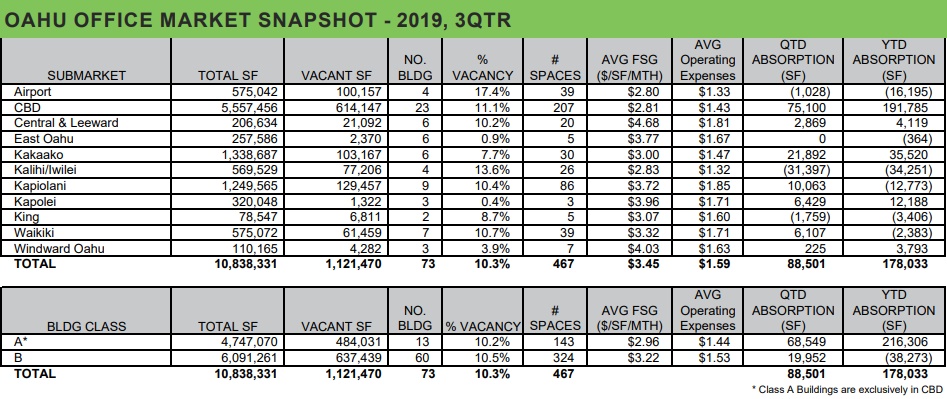

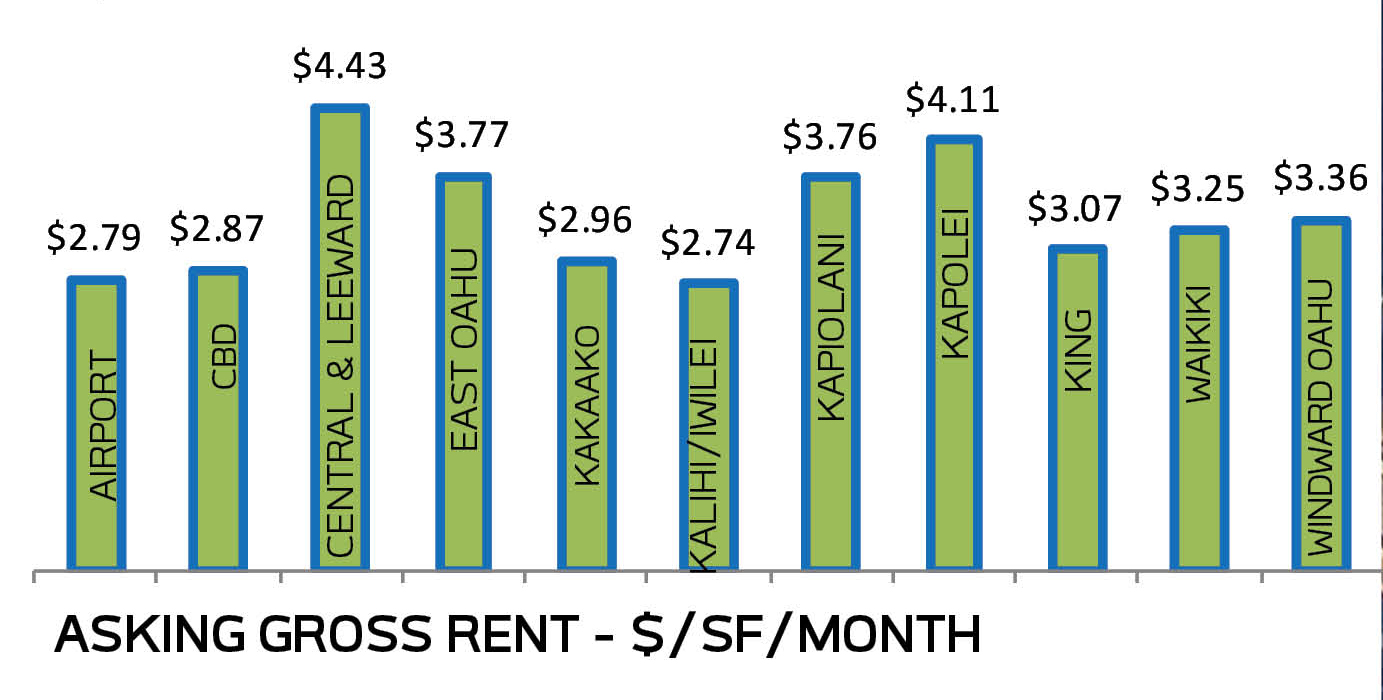

Full Service Gross (FSG) asking rent (base rent plus full-service

operating expenses) and operating expenses remained unchanged at

$3.45/sf/mth and $1.59/sf/mth.

Hawaii Commercial Real Estate’s index of available spaces also remained unchanged at 467 spaces across the island.

CHANGES IN INVENTORY AND TENANCY

to Waterfront Plaza.

2020 has more changes in store. HECO will commence its lease of 195,000 sf at

Alii Place which removes 100,000 sf of vacancy at Alii Place and forces 95,000 sf

of tenancy (IRS and HART) into the market. HECO will give back 250,000 sf in six

buildings over the next several years, and while most of that tenancy expires in 2021

and beyond, we could see some of that space on the market in 2020. Pioneer Plaza

is closing the Plaza Club to convert its top two floors to office space, one of which

will go to HDS. Topa’s vacancy will grow to over 100,000 sf when the University of

Phoenix gives back 2 ½ floors in April and HDS vacates 1 ½ floor to move to part of the former Plaza Club space. We will see 1132 Bishop tenants continue moving elsewhere as that building converts to residential use.

HECO ANNOUNCES 195K SF LEASE

Over the next several years, HECO will vacate nearly 250,000 sf in ASB Tower, Pauahi Tower, Central Pacific Plaza, Pacific Park Plaza, Honolulu Club Building and Waterhouse Building.

CHANGING OFFICE MARKET – VACANCY HEADED BELOW 10%

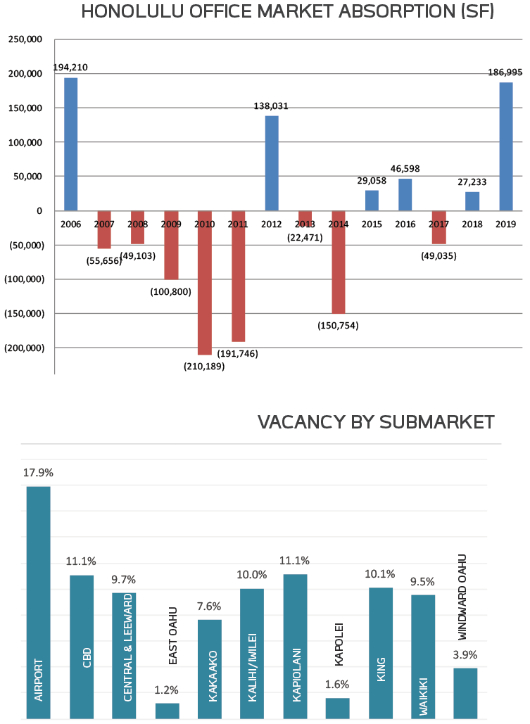

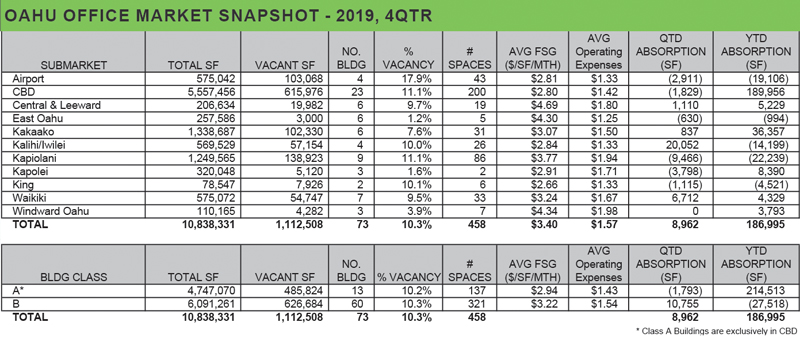

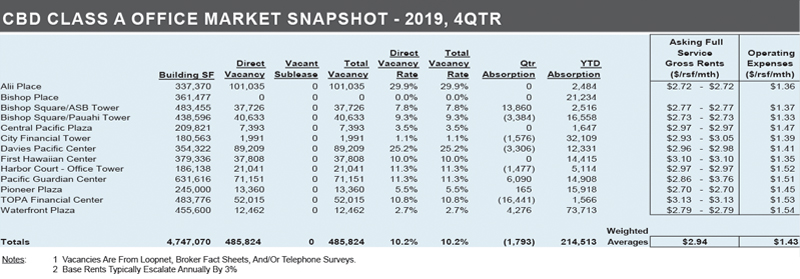

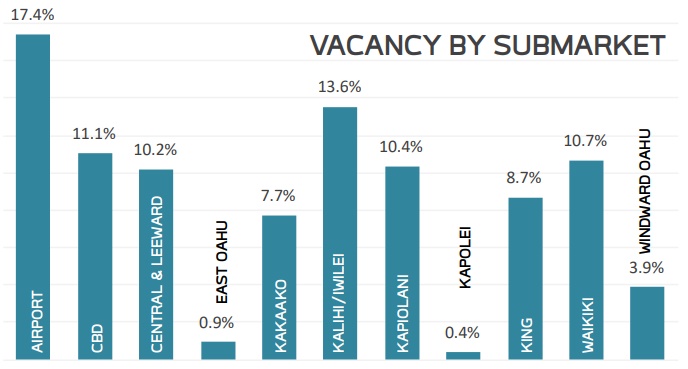

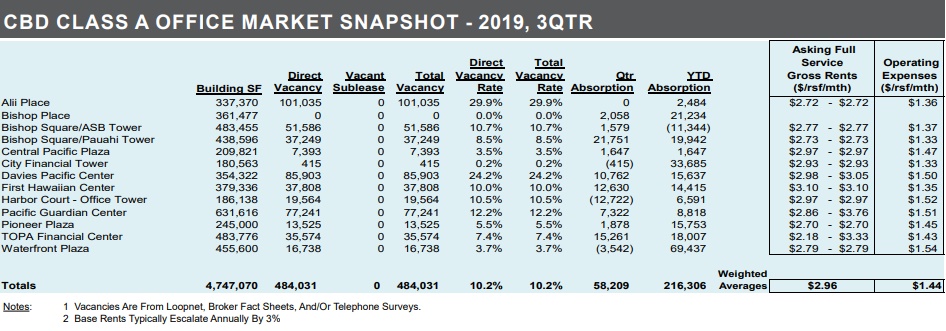

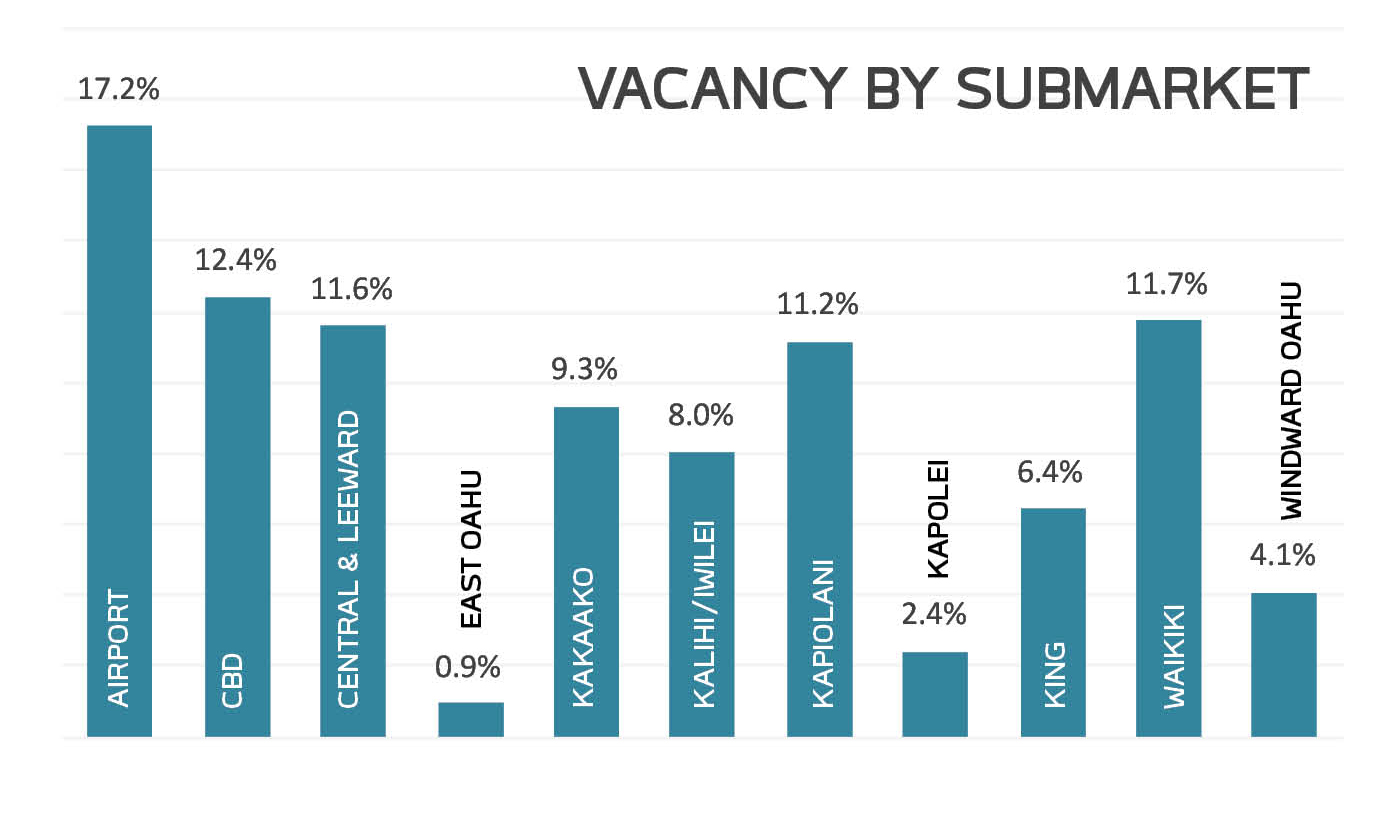

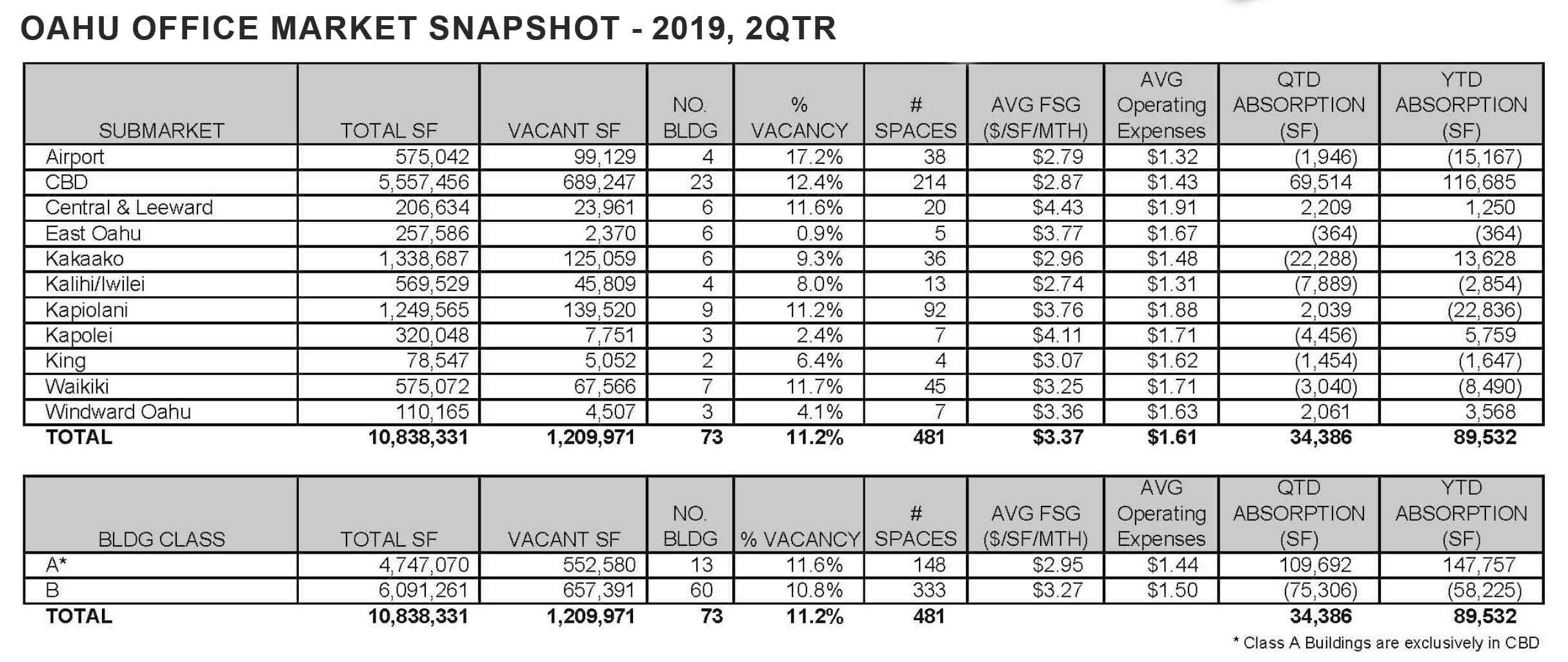

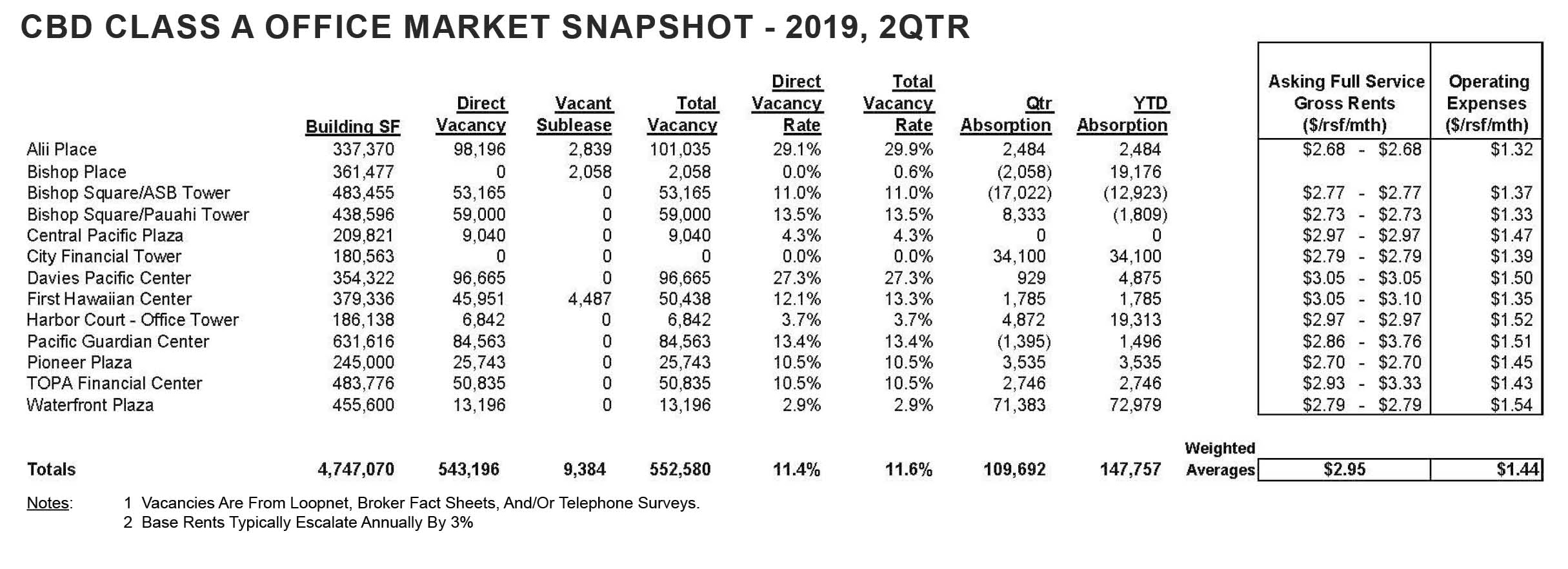

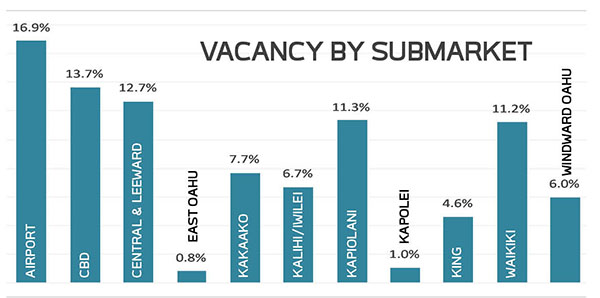

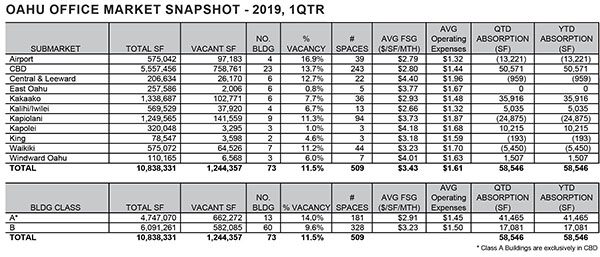

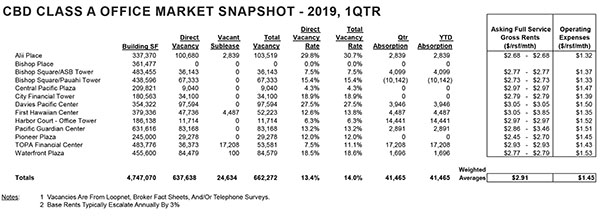

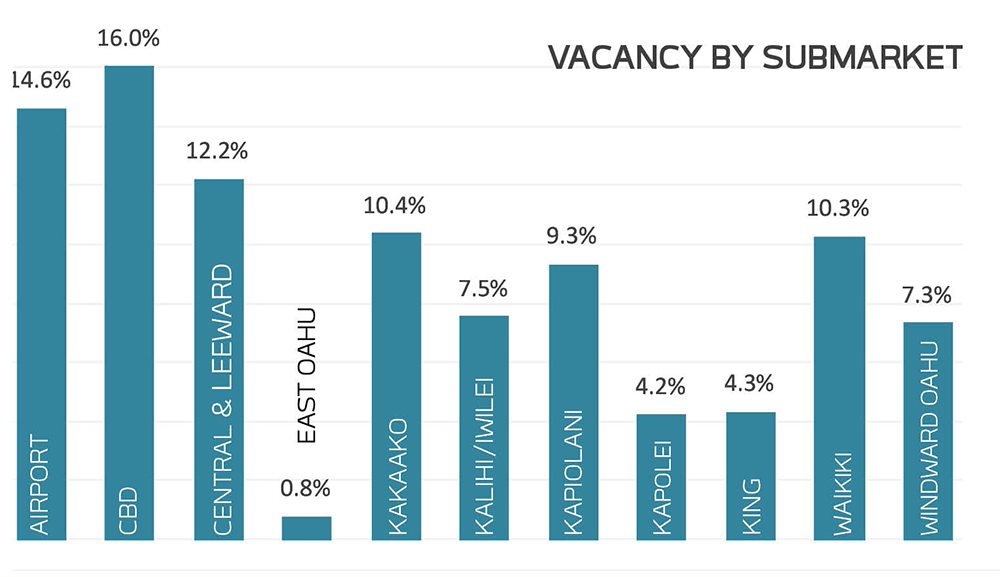

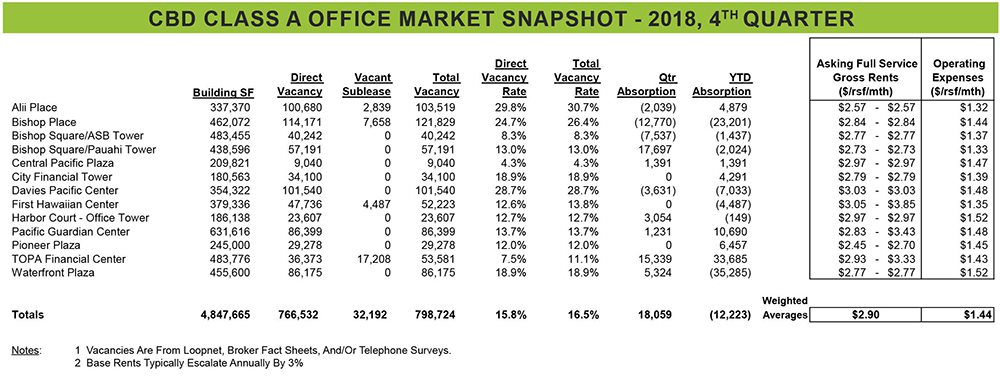

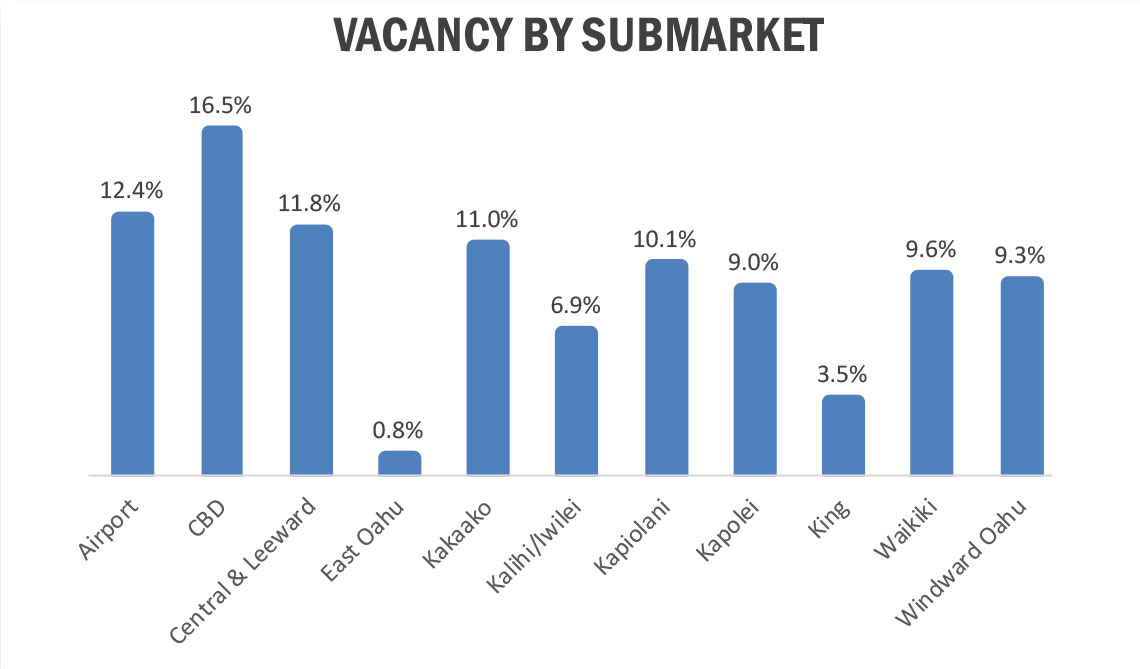

Ten percent vacancy is general regarded as the tipping point between a tenant’s market and a landlord’s market. After years of stagnation, the Honolulu Office Market and more specifically the Honolulu CBD Class A Market which has 50% of Honolulu’s inventory, has seen a dramatic drop in vacancy in 2019. The entire market has dropped to 10.3% vacant while the CBD Class A market has dropped to 10.2% vacant.

In early 2020, HECO’s new lease will bring the CBD Class A market down to 8.1% vacant, and depending on where IRS and HART move, vacancy could go even lower. In the longer run, vacancy should trend back higher as HECO gives back nearly 250,000 sf

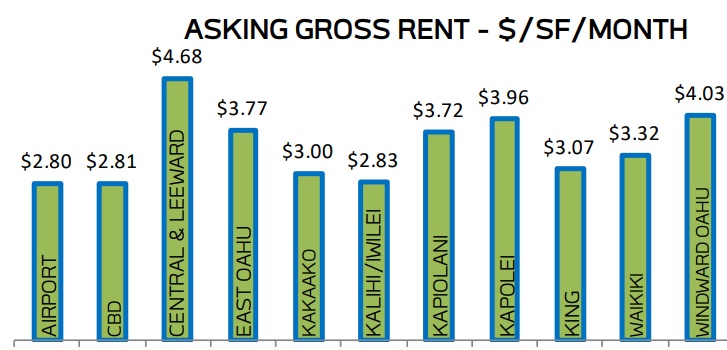

While there are still some tenant-favorable deals being made, the days of tenants having the upper hand are very short and in some cases over. We are seeing much more stratification of rents where the better spaces command higher rents.

DOWNLOAD 2019 3rd QTR. REPORT (PDF)

BISHOP PLACE CONVERSION; HPU AND ASB MOVES

HPU moved about 70,000 sf of tenancy to Waterfront Plaza from a combination of untracked office space at the Mauka end of Fort Street Mall and from Finance Factors Center.

While downtown’s Class A buildings filled up, Kakaako and Kalihi/Iwilei went the opposite direction as ASB moved out of about 14,000 sf in 677 Ala Moana, Xerox put 11,000 sf of space on the market for sublease in 677 Ala Moana and Johnson Controls vacated about 10,000 sf at the New Media Center on Waiakamilo Road.

DOWNLOAD 2019 2nd QTR. REPORT (PDF)

BISHOP PLACE CONVERSION

DOWNLOAD 2018 4TH QTR. REPORT (PDF)

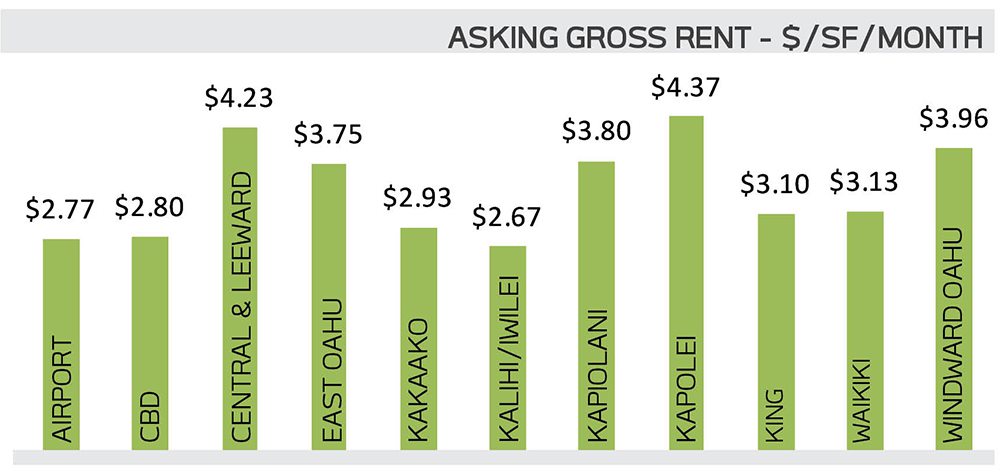

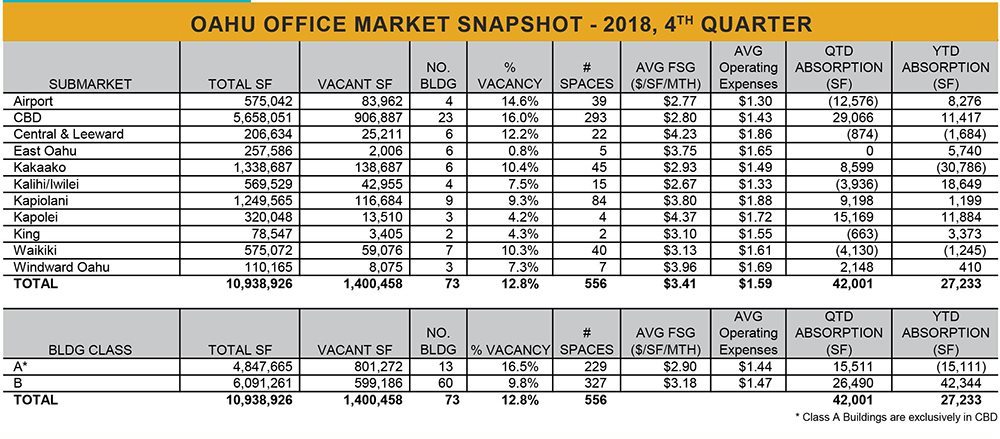

with 42,001sf of positive absorption decreasing the overall vacancy rate from 13.2% to

12.8%, the same as the end of 2017. The largest occupancy gainers were Downtown

and Kapolei while the Airport submarket gave up about 13,000 sf as Critchfield Pacific

put a large office space on the market for sublease at 590 Paiea Street.

BISHOP PLACE CONVERSION

DOWNLOAD 2018 4TH QTR. REPORT (PDF)

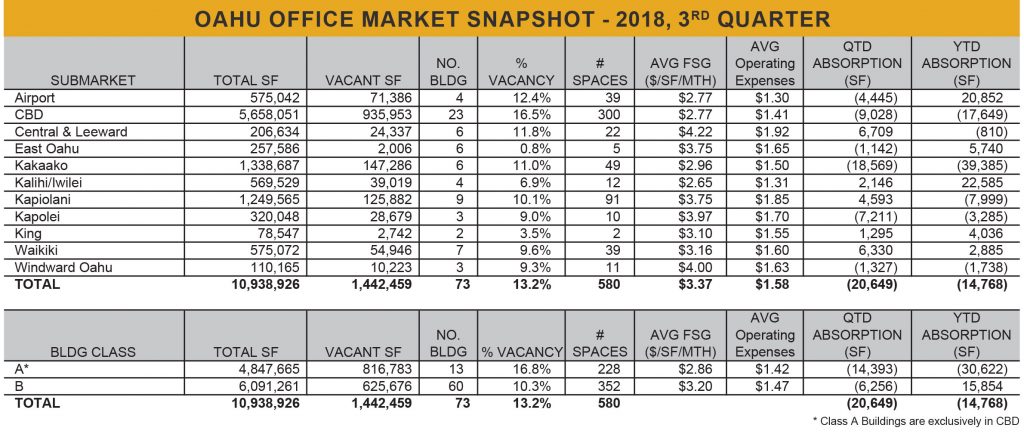

vacancy rate from 13.1% to 13.2%, slightly higher than the end of 2017. The largest occupancy losers were 677 Ala Moana Boulevard in Kakaako, Davies Pacific Center and Finance Factors Center downtown, and Campbell Square in Kapolei. Occupancy gainers included The Block and Topa Financial Center downtown.

Bishop Square

CHANGES IN STORE FOR 2019?

On the negative side, ASB will be moving to its new campus in 2019 and will be vacating more than 100,000 sf across multiple properties, however most of that is untracked inventory. Remington College is closing and will vacate about 30,000 sf of untracked office. In the longer run, Hawaiian Electric has an RFP out to consolidate its leased and owned office space in a single owned property. This could potentially create significant vacancies at ASB Tower and Central Pacific Plaza.

On the negative side, ASB will be moving to its new campus in 2019 and will be vacating more than 100,000 sf across multiple properties, however most of that is untracked inventory. Remington College is closing and will vacate about 30,000 sf of untracked office. In the longer run, Hawaiian Electric has an RFP out to consolidate its leased and owned office space in a single owned property. This could potentially create significant vacancies at ASB Tower and Central Pacific Plaza.

ASB moves to its new campus in 2019.

DOWNLOAD 2018 3RD QTR. REPORT (PDF)

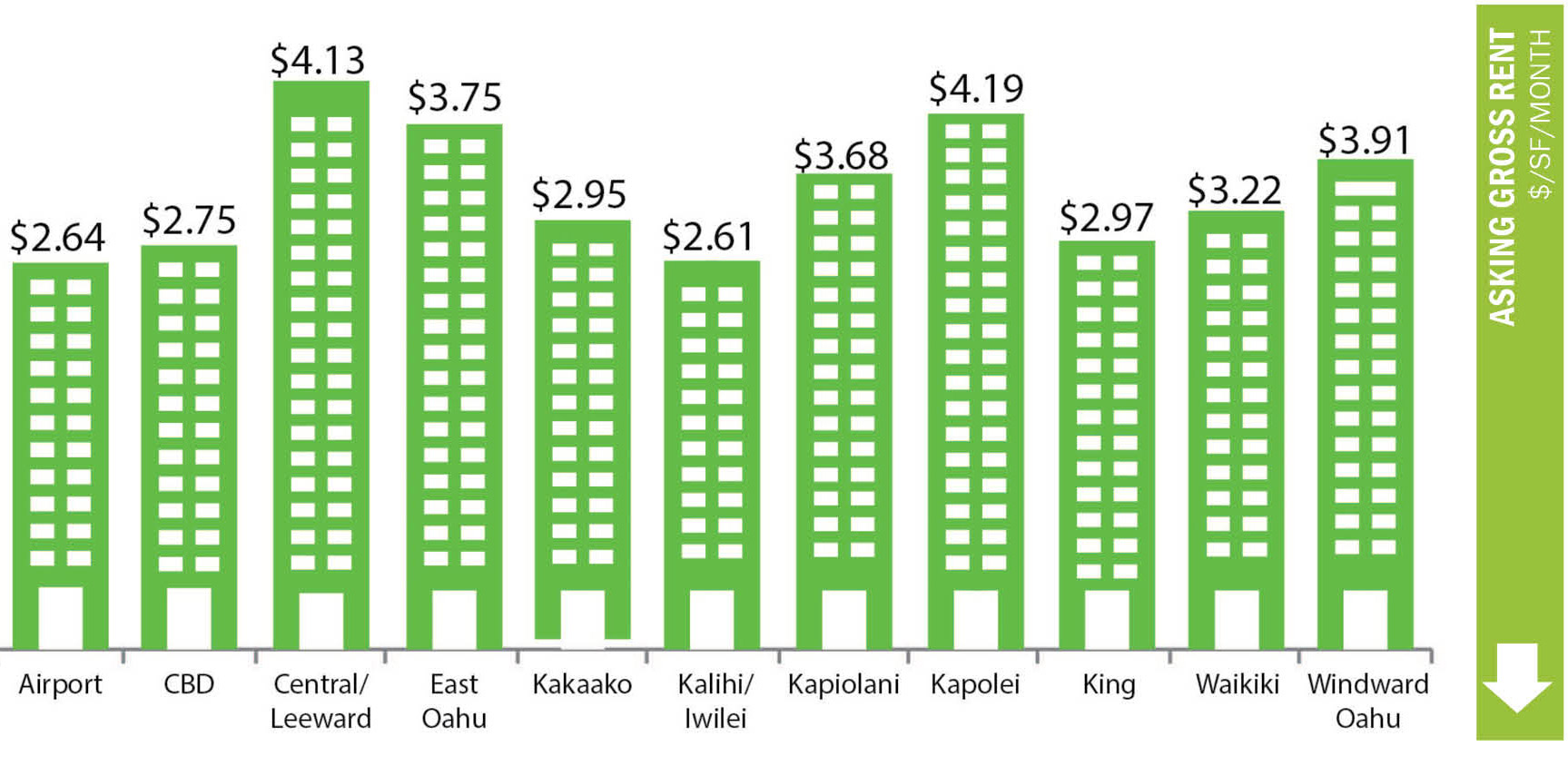

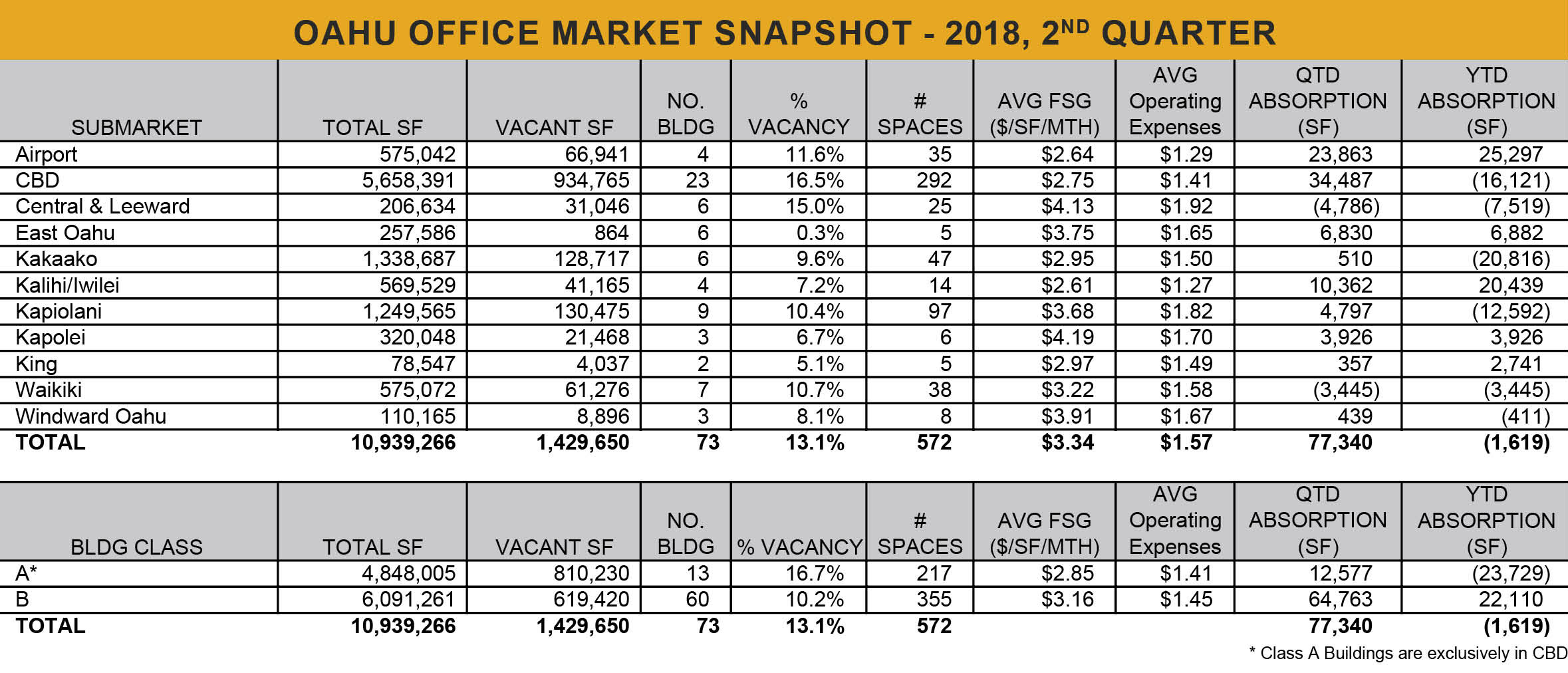

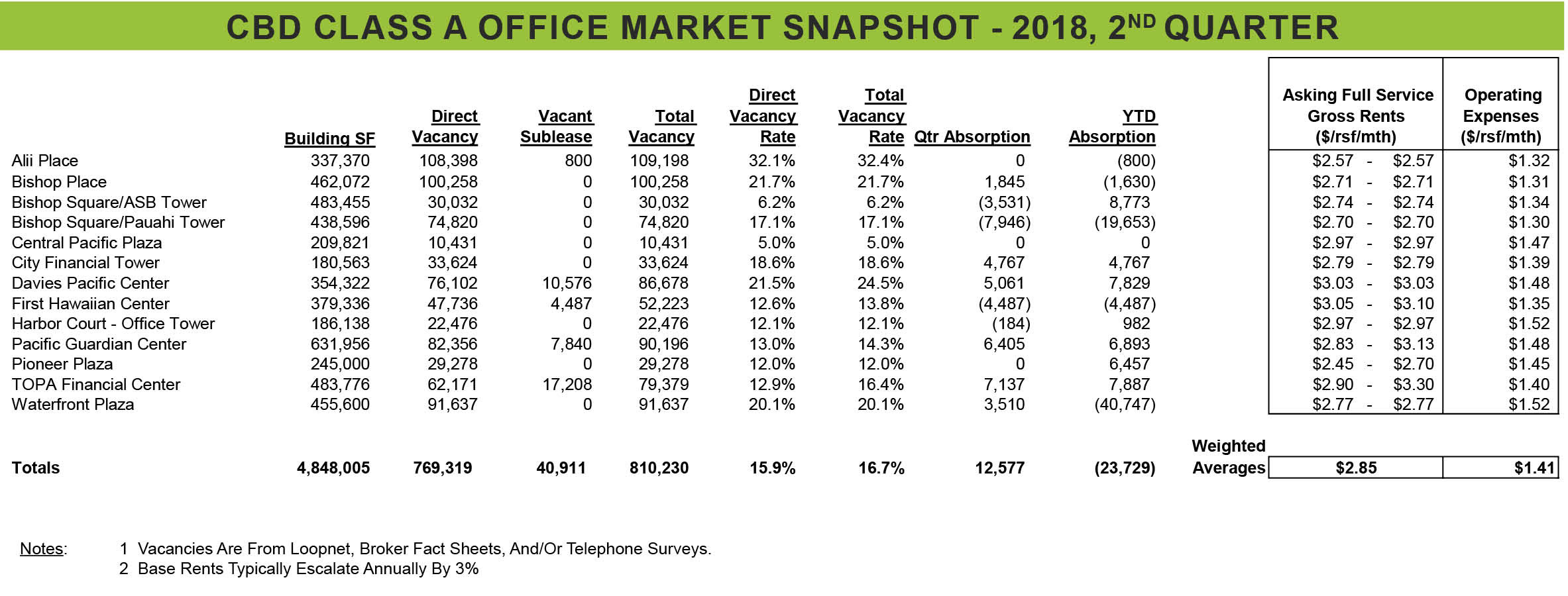

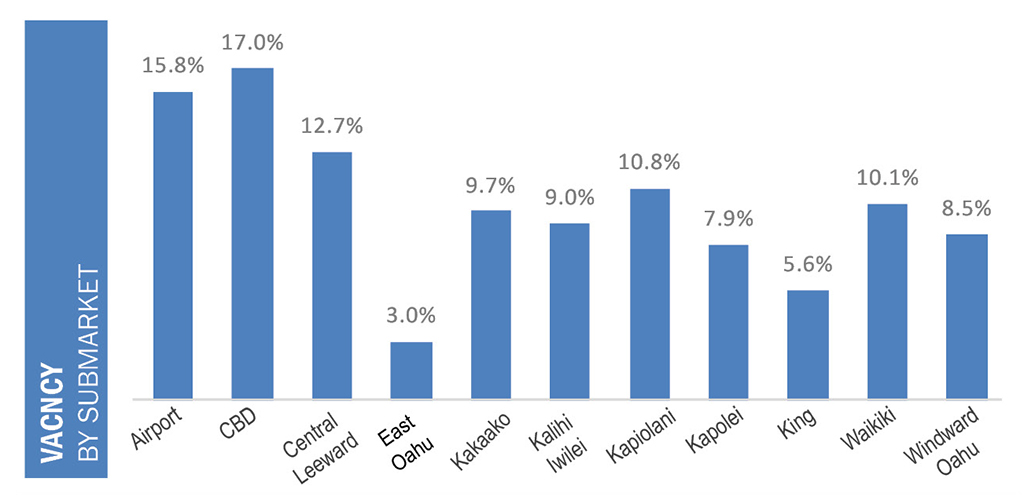

Honolulu’s office market ended the second quarter of 2018 with 77,340 sf of positive absorption which decreased the overall vacancy rate from 13.7% to 13.1%, the same rate at the end of 2017.

Full Service Gross (FSG) asking rent (base rent plus full-service operating expenses) decreased from $3.35/sf/mth to $3.34/sf/mth. Hawaii Commercial Real Estate’s index of available spaces increased from 571 to 572 spaces across the island.

CHANGE IN OFFICE DEMAND?

Pacific Guardian Center

In recent months most of our showings are for smaller tenants (less than 2,000 sf with many less than 1,000 sf). The market has a limited supply of very small spaces (less than 500 sf), and we have seen premium rental rates for these spaces. At Pacific Guardian Center, for example, our vacancies less than 1,000 sf are leased almost as soon as we can get them ready to lease at very high rental rates. We have seen an increase in business suites and co-working operations. For example, Impact Hub leased 14,000 sf last year at 1050 Queen Street just Mauka of the new Whole Foods in Ward Village, and they are already expanding. 1164 Bishop converted several thousand sf of a vacant law firm space into a un-manned business suites operation, and they have 7 of 8 offices rented out. Pacific Guardian Center is converting a similar space with 8 window

Impact Hub’s Co-Working space at 1050 Queen St.

offices into PGC Business Suites and has its first tenant even before it is open. We have even seen one of downtown’ s largest law firms offer another small law firm 3 offices and two workstations complete with support services for a very competitive price. The 60 day right to cancel by either party is a plus for the small law firm who wants flexibility. What do these tenants have in common? They generally are looking for shorter term (less than 3 years) in spaces they can move into within a month. They tend to be service professionals such as attorneys, financial planners, mortgage brokers, CPAs, and entrepreneurs. Many are tired of working from home and Starbucks.

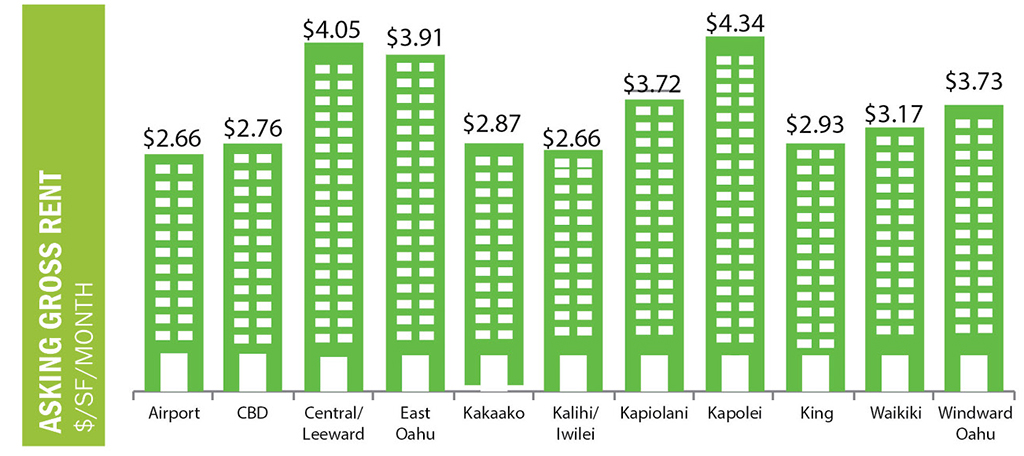

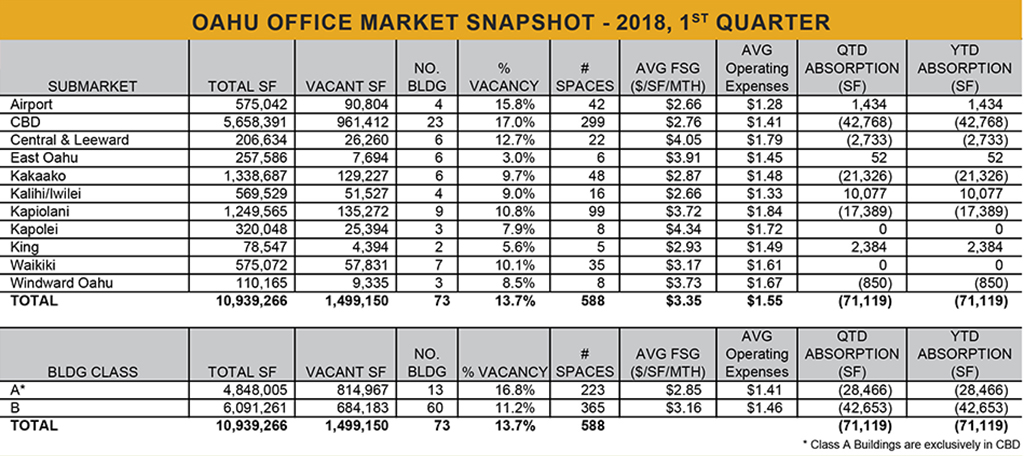

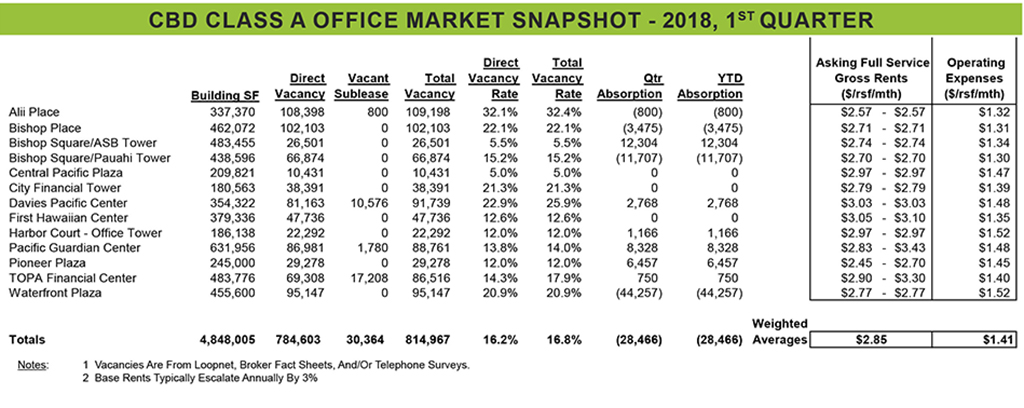

Honolulu’s office market ended the first quarter of 2018 with 71,119 sf of negative absorption which increased the overall vacancy rate from 13.1% to 13.7%.Full Service Gross (FSG) asking rent (base rent plus full-service operating expenses) decreased from $3.39/sf/month to $3.35/sf/month. Hawaii Commercial Real Estate’s index of available spaces increased from 571 to 588 spaces across the island.

500,000 SF OF NEW OFFICE INVENTORY?

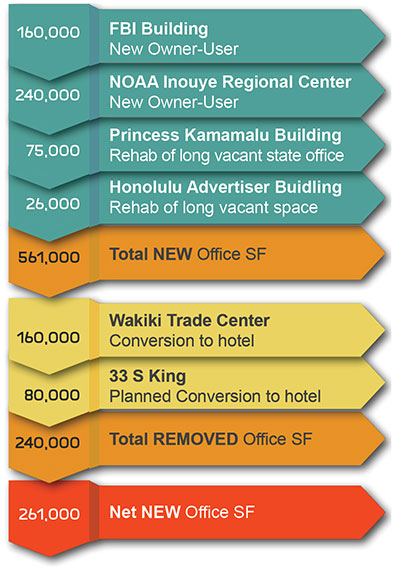

It has been 22 years since the last major office building, First Hawaiian Center, was delivered to the Honolulu market. First Hawaiian Bank originally occupied more than half of the 380,000 sf building, so the multi-tenant square footage increase was only about 150,000 sf. Office jobs are up; so why has vacancy increased if we have not been adding new inventory? We have long known that reductions in sf/employee has been a major contributor to negative absorption and vacancy increases, but the there is more to the story. By our estimates, owner-user office space has added 500,000 sf of inventory in the past 5-10 years. That’s a large downtown office tower! Owner-user inventory is not

It has been 22 years since the last major office building, First Hawaiian Center, was delivered to the Honolulu market. First Hawaiian Bank originally occupied more than half of the 380,000 sf building, so the multi-tenant square footage increase was only about 150,000 sf. Office jobs are up; so why has vacancy increased if we have not been adding new inventory? We have long known that reductions in sf/employee has been a major contributor to negative absorption and vacancy increases, but the there is more to the story. By our estimates, owner-user office space has added 500,000 sf of inventory in the past 5-10 years. That’s a large downtown office tower! Owner-user inventory is not

tracked so it does not have a direct impact inventory, but these buildings have pulled tenancy directly from other private office buildings and/or have created a trickle-down effect.

To be fair, about 240,000 sf has been removed from inventory during the same time with the conversion of Waikiki Trade Center to Hyatt Centric and 33 S. King’s planned TBD conversion, so the net increase is 261,000 sf but that is still more than the net impact of First Hawaiian Center in 1996.

Looking ahead, ASB’s new campus scheduled for occupancy in early 2018 will add another 135,000 sf of owner-user inventory which could have a similar effect. ASB will vacate tracked inventory in ASB Tower and 677 Ala Moana and will vacate untracked inventory in the Financial Plaza of the Pacific and Chinatown. A potential conversion of 1833 Kalakaua would remove about 90,000 sf of tracked office inventory.

Looking ahead, ASB’s new campus scheduled for occupancy in early 2018 will add another 135,000 sf of owner-user inventory which could have a similar effect. ASB will vacate tracked inventory in ASB Tower and 677 Ala Moana and will vacate untracked inventory in the Financial Plaza of the Pacific and Chinatown. A potential conversion of 1833 Kalakaua would remove about 90,000 sf of tracked office inventory.

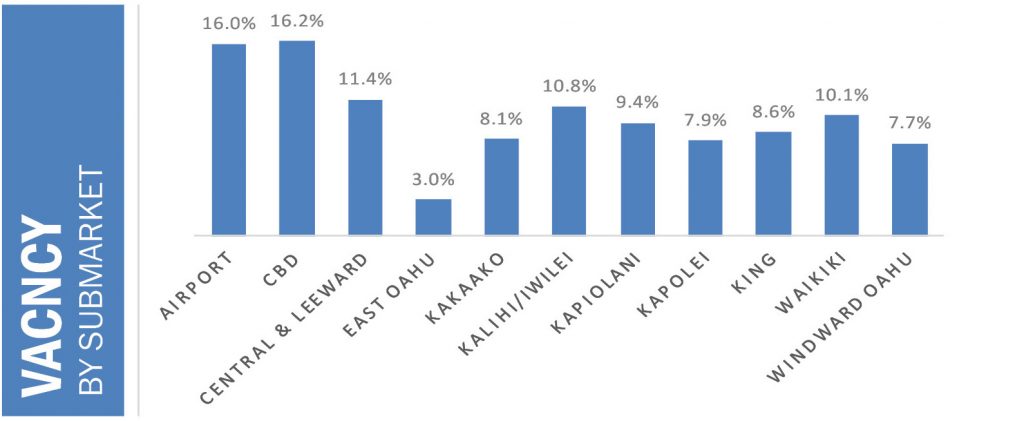

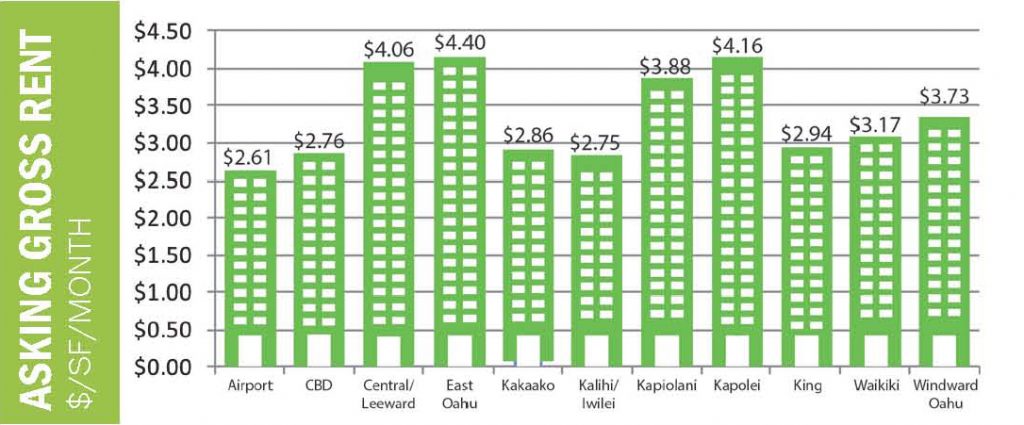

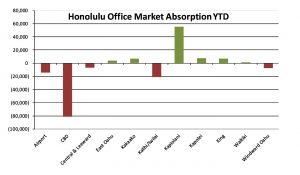

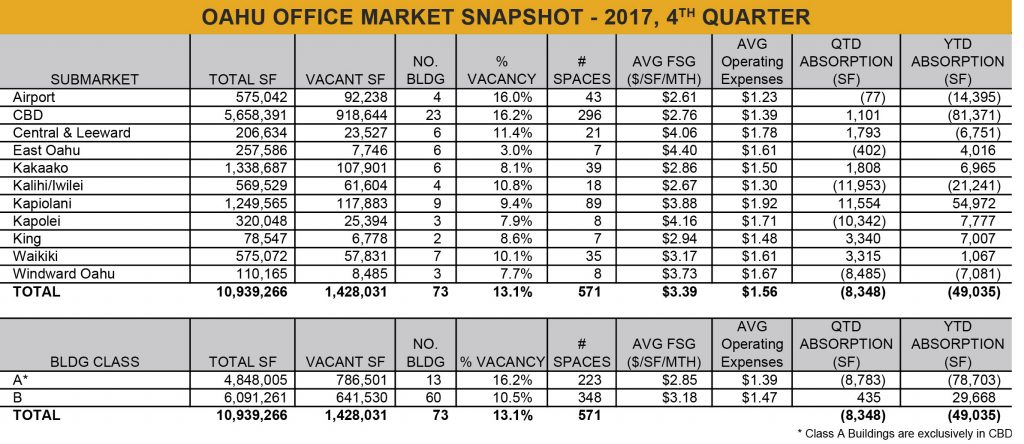

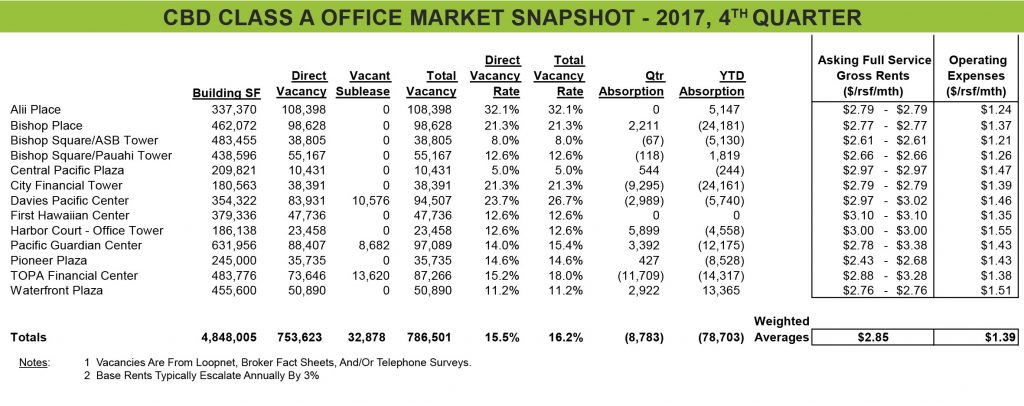

Honolulu’s office market ended 2017 with 8,348 sf of negative absorption in the 4th quarter to bring the YTD total to 49,035 sf of negative absorption. The overall vacancy rate increased from 13.0% to 13.1%.

Full-Service Gross (FSG) asking rent (base rent plus full-service operating expenses) increased from $3.33 to $3.39/sf/mth. Hawaii Commercial Real Estate’s index of available spaces decreased from 572 to 571 spaces across the island.

OCCUPANCY WINNERS AND LOSERS IN 2017

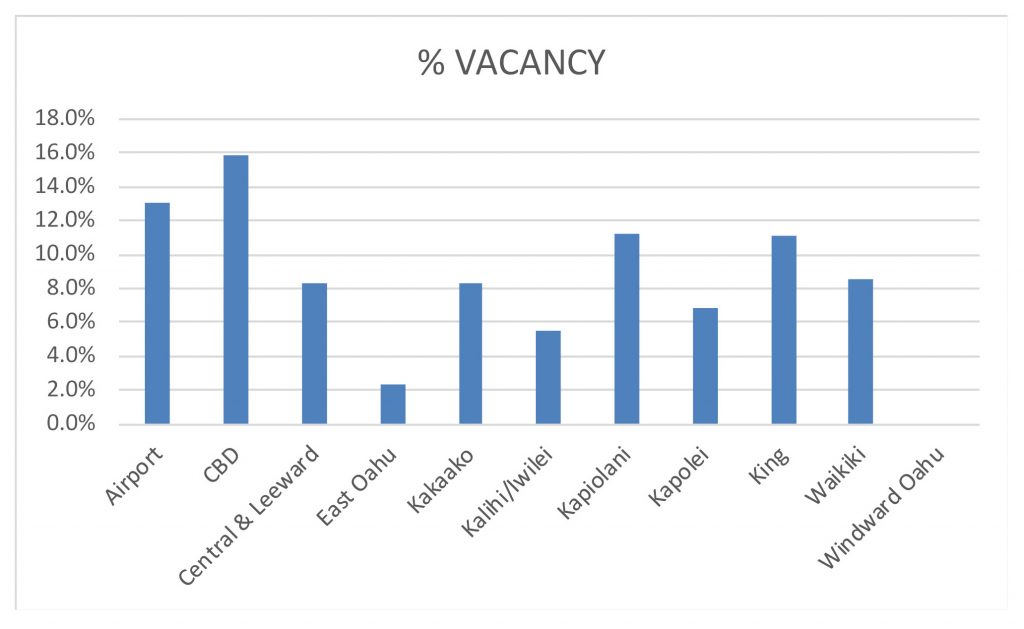

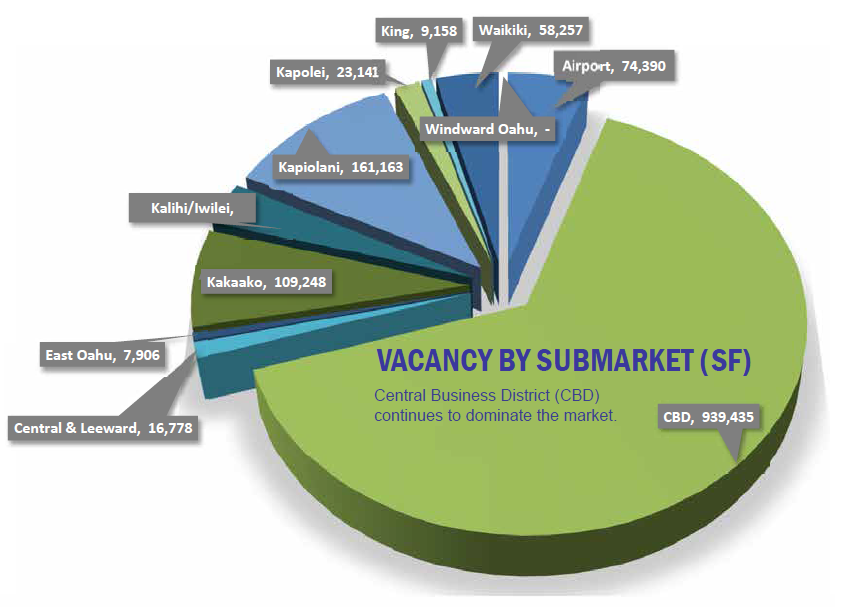

Honolulu’s largest and second largest submarkets moved in opposite directions during the year with downtown’s Central Business District giving up 81,371 sf of occupancy while Kapiolani gained 54,972 sf of occupancy.

Honolulu’s largest and second largest submarkets moved in opposite directions during the year with downtown’s Central Business District giving up 81,371 sf of occupancy while Kapiolani gained 54,972 sf of occupancy.

Downtown’s woes were driven by Hawaiian Dredging’s move from City Financial Tower to the former Honolulu

City Financial Tower

Airport Center

Honolulu Advertiser Building

Advertiser Building, the loss of a temporary movie production tenant, and continued “rightsizing” by tenants. Kapiolani benefited from HMSA’s expansion into the former NOAA space at 1601 Kapiolani as they renovate their building on Keeaumoku Street. Beyond Honolulu’s urban core, Kalihi/ Iwilei lost occupancy as the State of Hawaii moved out of the New Media Center. The Airport submarket lost occupancy as several government contractors downsized or moved from Airport Center which is now owned but not occupied by Hawaiian Airlines. Central/Leeward and Windward Oahu also saw small losses in occupancy. The winners included Kapolei who gained occupancy during the year despite a negative 4th quarter, East Oahu, Kakaako and King Street. Waikiki occupancy was flat.

Advertiser Building, the loss of a temporary movie production tenant, and continued “rightsizing” by tenants. Kapiolani benefited from HMSA’s expansion into the former NOAA space at 1601 Kapiolani as they renovate their building on Keeaumoku Street. Beyond Honolulu’s urban core, Kalihi/ Iwilei lost occupancy as the State of Hawaii moved out of the New Media Center. The Airport submarket lost occupancy as several government contractors downsized or moved from Airport Center which is now owned but not occupied by Hawaiian Airlines. Central/Leeward and Windward Oahu also saw small losses in occupancy. The winners included Kapolei who gained occupancy during the year despite a negative 4th quarter, East Oahu, Kakaako and King Street. Waikiki occupancy was flat.

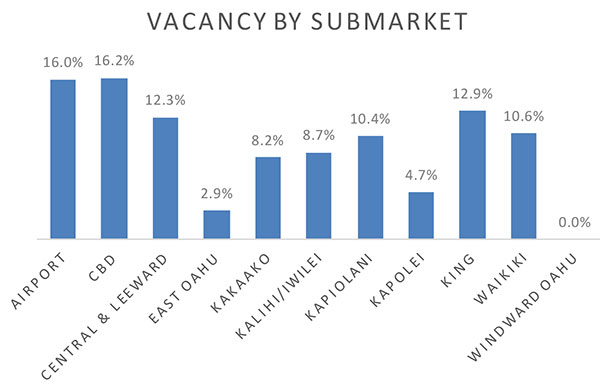

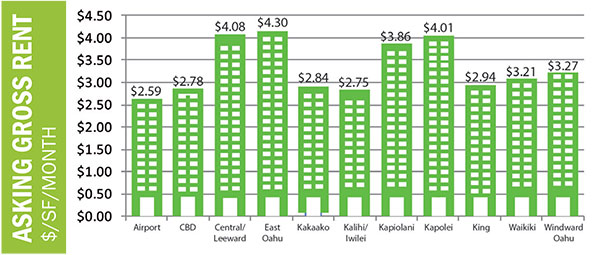

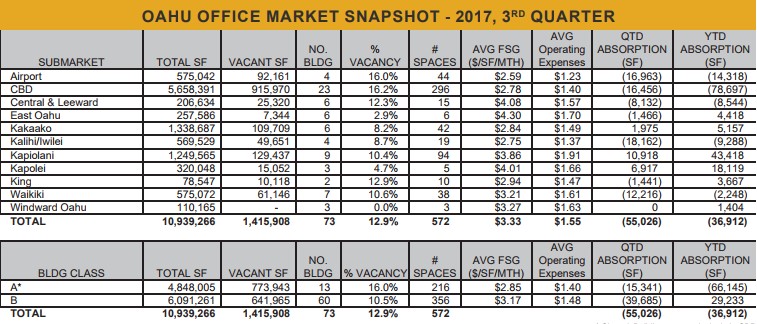

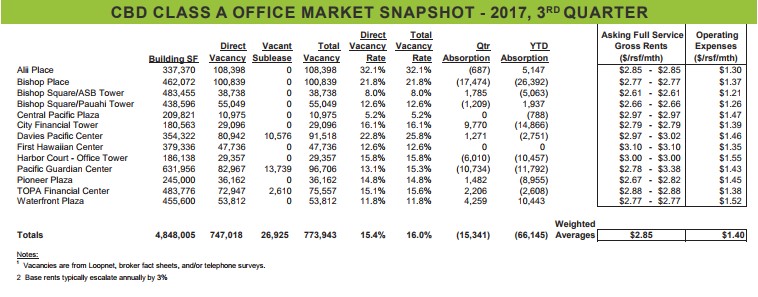

Honolulu’s office market reversed course yet again in the third quarter of 2017 with negative absorption in nearly every submarket and in both Class A and Class B properties. This follows positive absorption in the second quarter and negative

absorption in the first quarter.

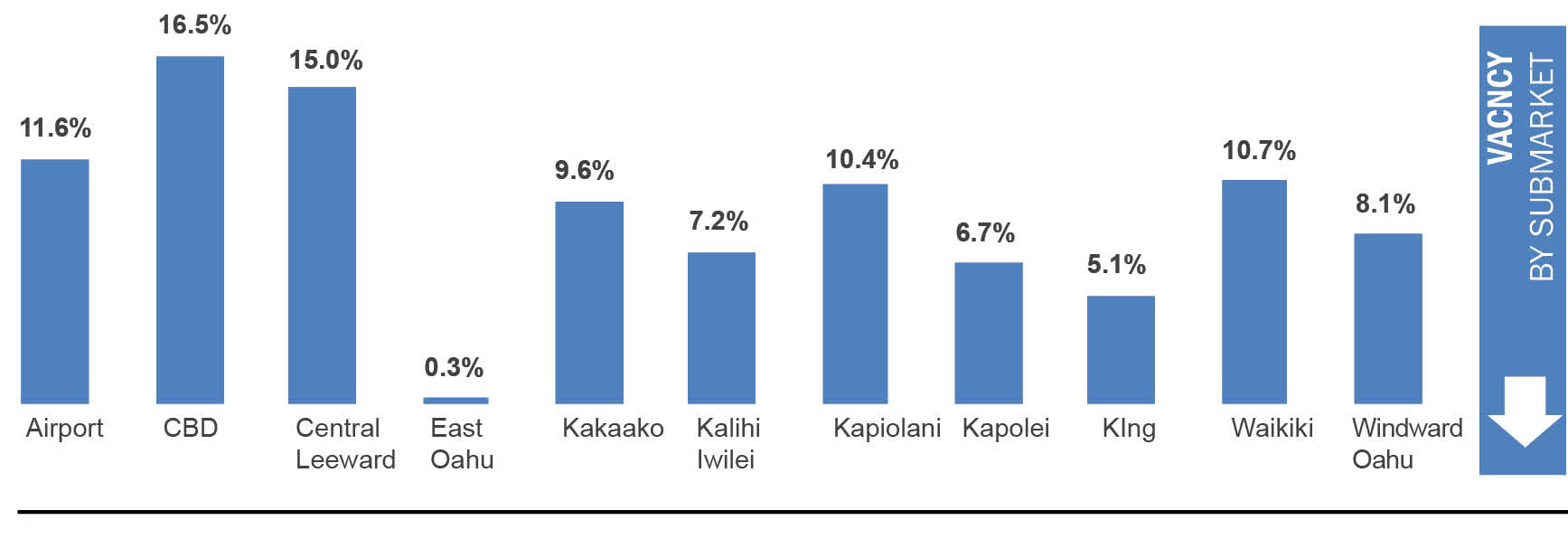

The entire market lost 55,026 square feet of occupancy which was spread across 7 of the 11 submarkets with Kapiolani and Kapolei being the exceptions. As a result, overall vacancy increased from 12.4% to 12.9%.

Full Service Gross (FSG) asking rent (base rent plus full-service operating expenses)

increased from $3.30/sf/mth to $3.33/sf/mth. Hawaii Commercial Real Estate’s index of available spaces increased from 565 to 572 spaces across the island.

SHORTER TIME HORIZONS AND HIGHER TENANT IMPROVEMENT COSTS MAKE IT TOUGH TO MOVE

In response to the rapidly changing business world, tenants are shortening their business planning horizon and are generally looking for shorter term leases. Tenants who once signed 7 and 10-year leases do not want such a long commitment and are now looking for 3 to 5-year leases. At the same time, tenant improvement costs have increased significantly which take a longer time to amortize. Combine shorter lease terms and higher TI costs and it is tough

for a tenant to move to a new space. The result is tenants increasingly look at modifying their current space or look for move alternatives that require minimal improvements.

FASB CHANGES

FASB (Financial Accounting Standards Board) changed rules in 2016 relating to assets and liabilities that arise from leases. The changes require that tenant

companies provide a more accurate representation of the liability of leases

on their balance sheets, and these rules take effect in December 2018 for public companies and December 2019 for private companies. The impact is not clear yet, but it could result in tenants opting for shorter term leases to reduce their balance sheet liability associated with their lease obligations.

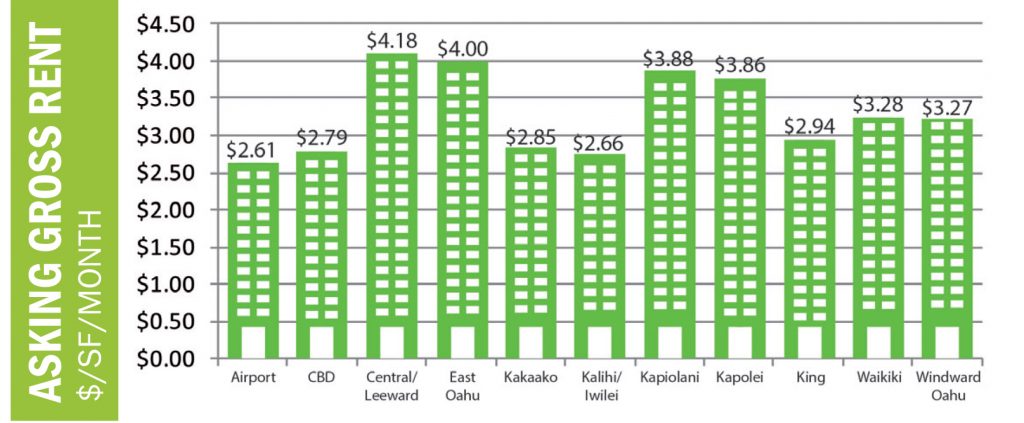

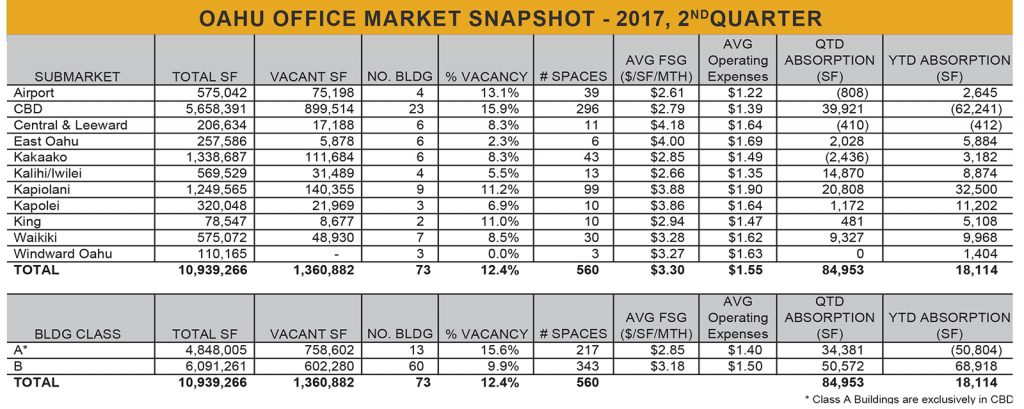

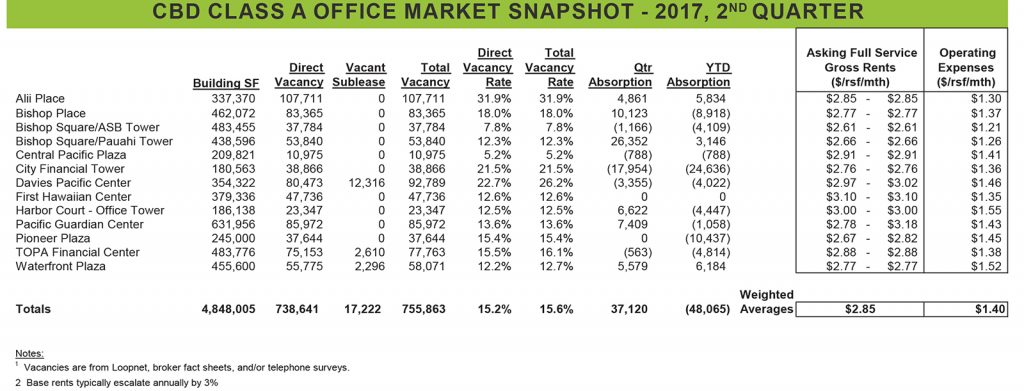

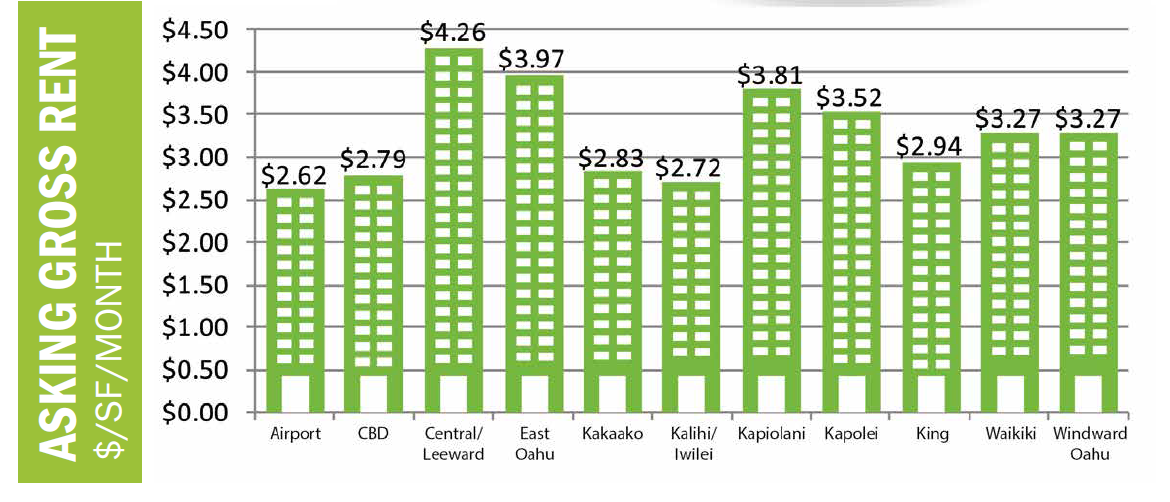

Honolulu’s office market reversed course again in the second quarter of 2017 with positive absorption in nearly every submarket and in both Class A and Class B properties.

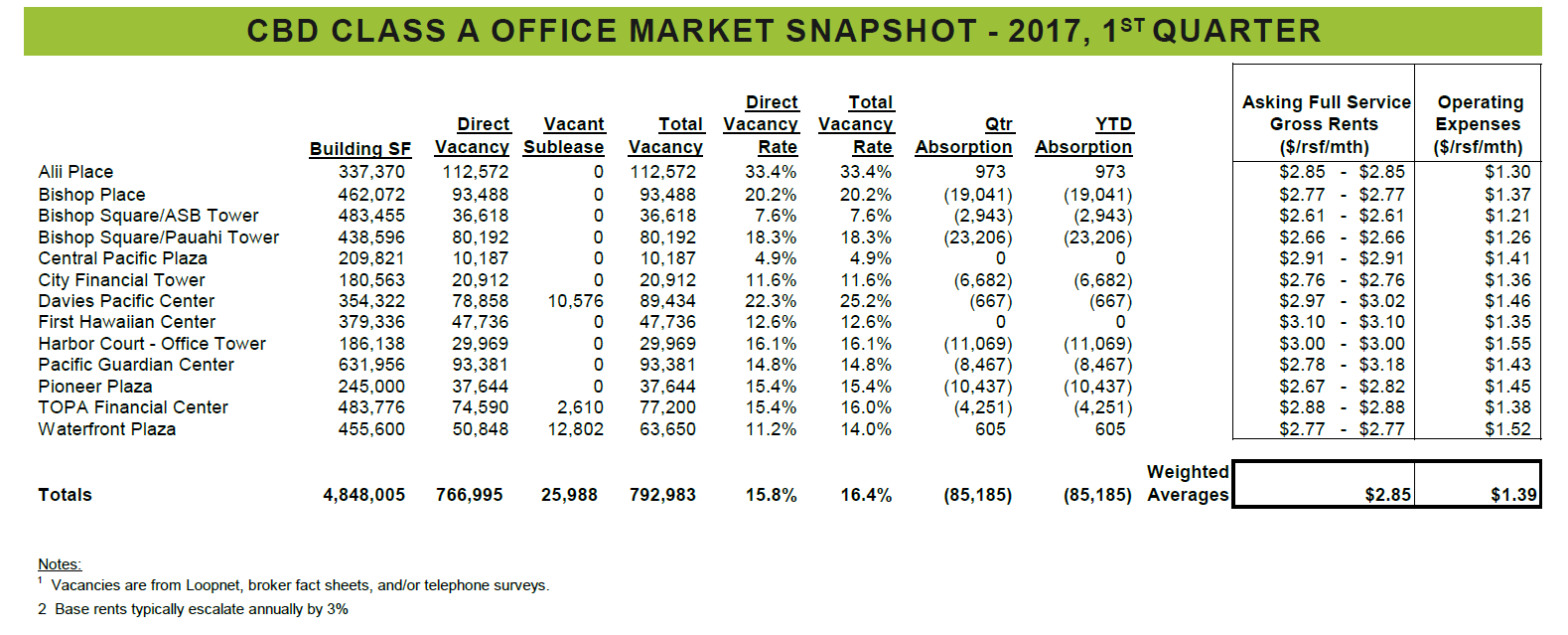

The entire market grew occupancy by 84,953 square feet with nearly half of that in downtown’s CBD. Class A high-rises which have struggled in recent quarters grew occupancy by nearly 35,000 square feet. As a result, overall vacancy decreased nearly a full percentage point from 13.2% to 12.4% while the CBD vacancy decreased from 16.9% to 15.9%. The Central Business District Class A which represents 44% of the market decreased its vacancy from 16.4% to 15.6%.

The entire market grew occupancy by 84,953 square feet with nearly half of that in downtown’s CBD. Class A high-rises which have struggled in recent quarters grew occupancy by nearly 35,000 square feet. As a result, overall vacancy decreased nearly a full percentage point from 13.2% to 12.4% while the CBD vacancy decreased from 16.9% to 15.9%. The Central Business District Class A which represents 44% of the market decreased its vacancy from 16.4% to 15.6%.

Full

Full Service Gross (FSG) asking rent (base rent plus full-service operating expenses) increased from $3.27/sf/mth to $3.30/sf/mth, the same rate at the end of 2016. Hawaii Commercial Real Estate’s index of available spaces decreased from 570 to 565 spaces across the island.

Rendering of American Savings Bank New Campus

IMPACT OF ASB CAMPUS

Construction of ASB’s new campus across Aala Park, just Ewa of Chinatown, is well underway. It is scheduled to be completed 3rd quarter, 2018 and the bank plans on moving in during the 4th quarter of 2018. This project indirectly creates new inventory across the island as ASB vacates all or a portion of 5 properties. The largest is ASB’s 55,000 square foot building which is part of the Financial Plaza of the Pacific, between BOH’s headquarters and Pioneer Plaza. The bank has put the property on the market for sale. Each floor is already condo mapped making it a likely office condo project, or it could be a corporate headquarters for one of the few tenants in town that needs that much space. ASB will also be vacating several other buildings, some owned by the bank and some leased by the bank.

MOVE-IN READY SPACES

Pacific Guardian Center and several other buildings continue to respond to market demand by outfitting vacant spaces so they are “move-in ready”. With long permitting and construction timelines, high tenant improvement costs and shorter lease terms, more tenants are opting for spaces that are ready to go. They don’t want to wait 4-6 months for design, permitting and construction. Move-in ready space improvements range from paint and carpet of an existing office to complete gut and rebuild in the case of old and obsolete configurations.

Move-In Ready: Dillingham Transportation Bldg.

Move-In Ready: Pacific Guardian Center

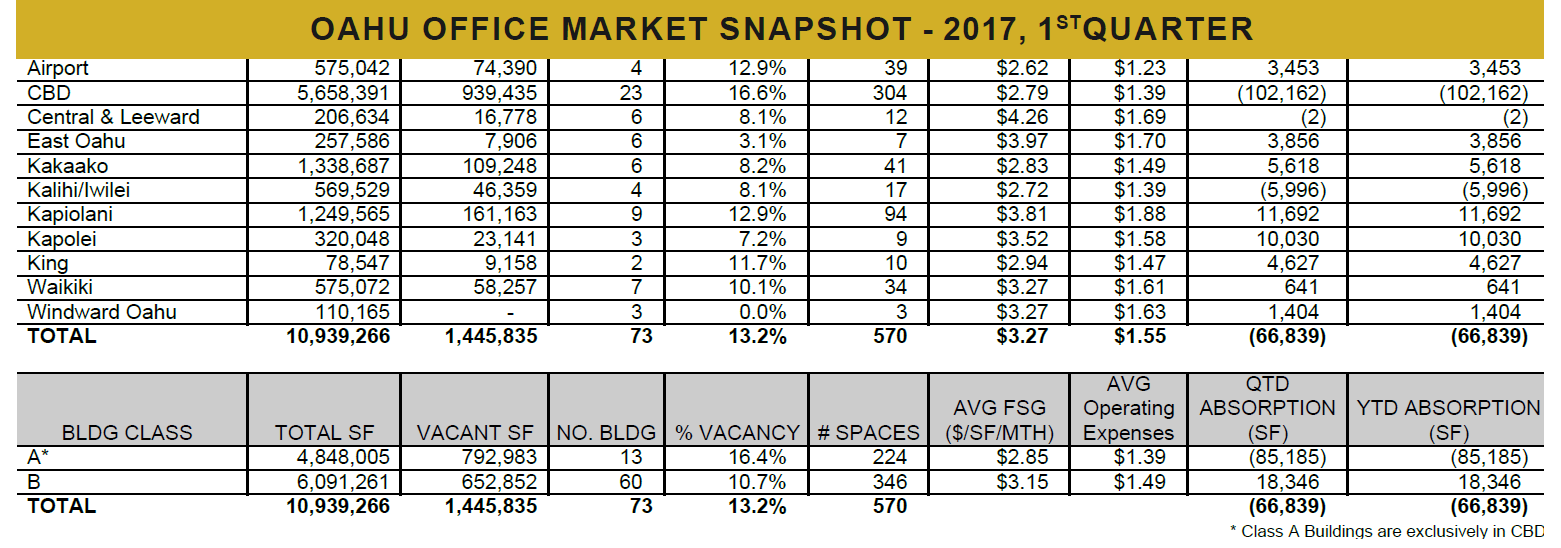

The first quarter of 2017 was a tale of two office markets. Downto wn high-rises and midrises saw significant negative absorption while the rest of the market grew occupancy. Kapiolani, Kapolei, Kakaako and the non-CBD submarkets collecti vely grew occupancy by 35,323 square feet while the CBD shed 102,162 square feet. As a result, overall vacancy increased from 13.0% to 13.2% while the CBD vacancy increased from 15.5% to 16.9% (note we adjusted our 4th quarter statistics to remove the former 33 S. King Street from CBD Class B inventory). The Central Business District Class A which represents 44% of the market increased its vacancy from 14.6% to 16.4%.

by 35,323 square feet while the CBD shed 102,162 square feet. As a result, overall vacancy increased from 13.0% to 13.2% while the CBD vacancy increased from 15.5% to 16.9% (note we adjusted our 4th quarter statistics to remove the former 33 S. King Street from CBD Class B inventory). The Central Business District Class A which represents 44% of the market increased its vacancy from 14.6% to 16.4%.  Asking Full Service Gross (FSG) rent (base rent plus full service operating expenses)

Asking Full Service Gross (FSG) rent (base rent plus full service operating expenses) declined from $3.30/sf/mth to $3.27/sf/mth with 1/3 of the the decrease coming from reductions in operating expenses. Hawaii Commercial Real Estate’s index of available spaces increased from 565 to 570 spaces across the island. It should be noted that our survey tracks Class A and B multitenant office buildings. If Class C and single-user buildings were added, we would have significantly lower vacancy rates.

declined from $3.30/sf/mth to $3.27/sf/mth with 1/3 of the the decrease coming from reductions in operating expenses. Hawaii Commercial Real Estate’s index of available spaces increased from 565 to 570 spaces across the island. It should be noted that our survey tracks Class A and B multitenant office buildings. If Class C and single-user buildings were added, we would have significantly lower vacancy rates.

CHANGES IN INVENTORY Slow office job growth continues to be offset by reductions in square feet per employee, and it seems the only way to reduce vacancy is to convert office space to other uses. When the Waikiki Trade Center was removed from inventory in 2015 to be converted to a hotel, Waikiki vacancy dropped from about 20% to about 10% and rent rates jumped.

One King Street (fka 33 S. King Street) was removed from CBD Class B office inventory at the end of 2016. The word on the street is that the approximately 90,000 square foot building will be converted to another use. The building was largely vacant with the remaining few tenants relocating to other CBD office buildings. On the other side of the equation, the State of Hawaii is nearing completion of the Princess Kamamalu building renovation which will add about 70,000 square feet of inventory, and ASB will add over 100,000 square feet of space to the market in 2019 when it completes its new campus and moves employees from other buildings. GROWTH INDUSTRIES Since the demise of the HECO/Next Era merger, HECO has been quietly expanding its downtown office footprint which has benefited ASB Tower and Central Pacific Plaza. And the flurry of alternative energy interest could result in office demand. Healthcare continues to be another potential bright spot as medical users look for alternatives to their oftentimes very old facilities. Medicare and Medicaid providers have a large office footprint in town. And, as discussed in our last market report, we could see co-working centers expand to fill some of the nearly 1.5 million square feet of vacancy.

Since the demise of the HECO/Next Era merger, HECO has been quietly expanding its downtown office footprint which has benefited ASB Tower and Central Pacific Plaza. And the flurry of alternative energy interest could result in office demand. Healthcare continues to be another potential bright spot as medical users look for alternatives to their oftentimes very old facilities. Medicare and Medicaid providers have a large office footprint in town. And, as discussed in our last market report, we could see co-working centers expand to fill some of the nearly 1.5 million square feet of vacancy.

HONOLULU MARKET REPORTS

HONOLULU OFFICE MARKET: 2017 4TH QTR

HONOLULU OFFICE MARKET: 2017 3RD QTR

HONOLULU OFFICE MARKET: 2017 2ND QTR

HONOLULU OFFICE MARKET: 2017 1ST QTR

HONOLULU OFFICE MARKET: 2016 4TH QTR

HONOLULU OFFICE MARKET: 2016 3RD QTR

HONOLULU OFFICE MARKET: 2016 2ND QTR

HONOLULU OFFICE MARKET: 2016 1ST QTR

HONOLULU OFFICE MARKET: 2015 4TH QTR

HONOLULU OFFICE MARKET: 2015 3RD QTR